The Mother Of All Bank Runs?

With thanks to our writer, Jorge Vilches

As The Mother Of All Bank Runs is definetly in the cards, I´ll hereinafter try to explain what may happen in highly simplified terms and , as always, before — not after — the facts. And please bear in mind that Monday-morning quarterbacking and any other type of 20-20 hindsight analysis would not help you to even partially mitigate the possible impact of the current financial situation worldwide. But first things first and so please be advised that a more technically-precise title for this article would be “ G7++ private wealth vs. Central Banks “. But experience indicates that the content sinks in far better and with faster dynamics with a title that cuts to the chase. BTW, I recommend to please very slowly re-read out loud the effective title that was finally selected. Thank you.

enter the savers

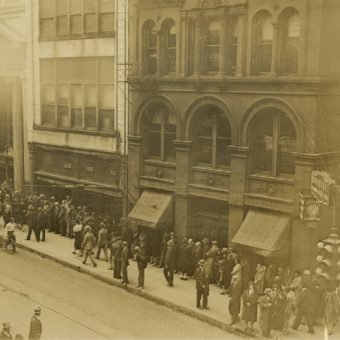

Be that as it may, what would be happening in today´s financial world is a heads-on frontal-crash between savers and so-called “money authorities” for want of a better term. For there are approximately 56.000.000 millionaires in the world (40% in the US only) who have approximately a USD $200 trillion net worth. Of such, we can very safely assume – most probably much more — that 10% or approximately USD $ 20 TRILLION are right now in the hands of banks and/or other financial institutions. So the Mother of All Bank Runs would start whenever a large-enough fraction of those USD $ 20 Trillion moves out of the world´s financial system to buy non-financial assets such as tangible real state, art, cars, yachts, aircraft… and/or physical precious metals (bullion)… as later explained below. The above could also amount to much larger figures such as USD $ 30 or $ 40 Trillion and may also include the far smaller savings (still politically very important) of dozens if not hundreds of millions of upper middle class savers ( boomers, government & corporate executives, professionals, military and security, shareholders, self-employed, etc.etc.) both in the US and in the G7++ countries. Ref #1 : https://www.usdebtclock.org Ref #2 : https://www.zippia.com/advice/millionaire-statistics/

So both millionaires and upper middle class savers will defend the purchasing power and still effective value of their “money” (more on that later) with the only way they possibly have. Which means buying whatever tangibles they find thus dumping their now obviously risky savings in US dollars right on the US economy´s front lawn, pretty much as if it were a truck-load of manure. Of course, it would not necessarily be limited to the US dollar world, as by contagion and similar structural status and dynamics euros and pounds and yens can also step into the act and for the same reasons be dumped accordingly elsewhere. While on the other hand today´s “money authorities” will try every trick (including new ones) in their thick playbook to maintain their power and thusly remain in charge not of real “money” mind you but just of their current ´legal tender fiat currencies´ which translated means ´government-imposed funny money´ with NO intrinsic value (zero). So G7++ Central Banks will do their best to maintain their current (supposed) ´money´ as the legal Unit of Account (as it should be, in the sense of ´how much do I owe you for this?´) and also as the only legal Means of Payment (as it should also be, in the sense that ´our transaction has now been settled, right ?´ ) WRONG.

humongous debt still alive (… and kicking)

WRONG. Why “wrong” ? Because today´s Mickey Mouse fiat currency has zero Store of Value as real money should have and thus today transactions of goods and services are not ever actually settled. Currently, the buyer gets to keep and use the service or stuff (whatever) but the seller just gets to keep greenish-colored pieces of paper with pictures of distinguished statesmen and elegantly decorated with some gold-colored paraphernalia to confuse the bearer. Magnetic representations of bits and bytes projected onto a cathode ray tube screen are the same deal. Beware, even Federal Reserve ´notes´ (cash) have no link to anything tangible — let alone gold in any way, shape or form — since August 15, 1971, when then President Richard M. Nixon on an infamous Sunday evening from his most comfortable Camp David residence unilaterally and with an undisguised squirm on his face violated the Breton Woods Agreement as the foundational reference for the agreed Western World financial system. So just like that – casually – Nixon shut down the established gold parity of 35 dollars per ounce at the time which today is officially ´valued´ by the Fed at USD $ 42.22 per troy ounce compared to a market price of more than $2,000. By the way, please be advised that the Federal Reserve is as “Federal” as Federal Express – it is 100% privately owned — and has 0 (zero) reserves, did you know that ? The Fed´s balance sheet would never ever be endorsed let alone be approved by any CPA in the world.

Thunderdome

So assuming that such balance sheet is valid would be equivalent to assuming that a bunch of bloated kittens spoiled in an affluent suburbian home would behave the same way as a pride of lean and hungry wild lionesses roaming along the African savannah looking for some prey to pounce on. Still, as the current US financial / banking crisis keeps on inevitably growing and spreading, the final outcome that is now clearly sketching out for everyone to see would be a Thunderdome a-la-Mad Max where two men enter but only one man leaves, you follow ? In this case the two opposing parties would be savers on the one hand and central banks on the other. Fight to the death, no prisoners.

The Federal Reserve Board

5 largest banks & beyond

Economic and daily financial reality has not yet harmed the Western superiority complex only making things worse. Fortunately, highly-credentialed scholars do agree with the very serious and immediate systemic risks involved, but they would never say it with such hyperbole. For example, Pam and Russ Martens from Wall Street on Parade. But at least they do readily accept – such as Prof. Michael Hudson and others – that this situation is unsustainable ” with essentially the government itself and indirectly its so-called “regulators” working for the (5 largest) banks and against middle classes (emphasis mine). The existing financial system cannot survive in the way that it is now structured, because it makes any increase in interest rates drive banks insolvent” while the government will only support their campaign contributors, i.e., the 5 largest banks. Others say that “the unrealised losses on assets and debt securities held on the books of US banks simply have not been marked to market” with large quantities of uninsured deposits as described in the many references below

Ref #3: https://sovereignista.com/2023/05/06/ben-norton-michael-hudson-4-us-banks-crash-in-2-months/

Ref #6: https://www.ft.com/content/a8a56860-6092-4b55-aa50-78d989601bab

So basically your so-called ´money´ would only be safe at one of the five big ´systemically important´ banks whereby ´systemically important´ means that it’s a bank that controls government policy of the financial sector in its own favor. Question: would the many millions of wealthy people and the hundreds of millions of upper middle classes worldwide move their savings out of small banks and into the 5 dedicated survivor ´systemically-important´ large banks fast enough… or would many/most get caught ?Central bankers can declare a banking holiday on a Sunday afternoon tying down everyone´s hands for Monday morning quarterbacking 12 hours beforehand.

portrait of King Charles III painted in oils by artist Alastair Barford

King Charles III

But you may rightfully ask why would the millonaires and high net-worth middle classes of this world dump their US dollars with jumbo-size snow shovels onto the US economy´s front lawn ? The answer is simple: to get rid of them ASAP while such US dollars are still able to buy tangible stuff, be it property, cars, or whatever real-life produce and/or services are still accepted in exchange for US fiat dollars. Mind you, lots of unnecessary purchases will unavoidably take place so that would worsen the effectiveness of economic activities. But no one will want to be left standing holding the bag of too many depreciated (or actually “confiscated” or “frozen”) US dollars that actually cease to exist in bank accounts ASWKT to perform. Frozen funds would not purchase or contract anything while at the same time possibly cash – after decades of waiting in the financial hallways — will finally become King same as Charles III.

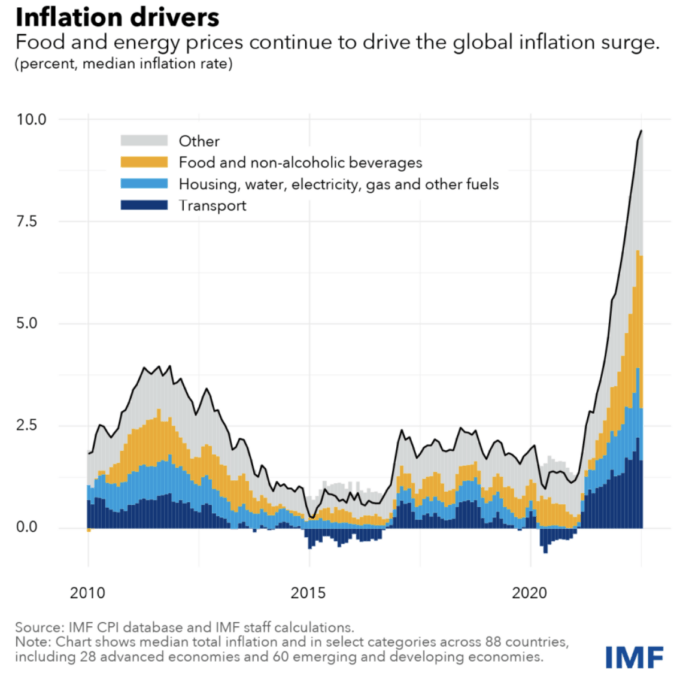

the inflationary bombshell

Below please find an updated IMF graph briefly depicting the current global CPI inflation rate which worsens by the hour. So in medical terminology this situation should be deemed to be progressively “terminal” both for the US economy and the US dollar which will necessarily also have tremendous positive and negative impact upon the rest of the world. No tricks have been left aside, no effective tools remain to be used. The covers are simply too short, something´s got to give.

Ambrose Evans-Pritchard in his very recent article in “The Telegraph” assures that the twin crashes in US commercial real estate and the US bond market have left half of US banks potentially insolvent thus leaving $9 trillion (Nine TRILLION dollars) uninsured deposits in the American banking system. Such can now vanish from one day to the other as these “banks” currently have assets worth far less than their liabilities. Furthermore, the signs of current worldwide de-dollarization are all around us now as Radhika Desai has correctly observed. So the Fed today has to either “try” to save the US banks or “try” to save the US dollar, but not both with no real tools available to do either. The US Fed has yet again created fake “money” out of thin air, this time to the tune of USD $9 trillion to be added to the rest and only to allow the banks to drive down interest rates to almost near zero which under current circumstances necessarily means rampant price inflation of everything imaginable.

Ref #8 : https://www.rt.com/business/575849-dedollarization-us-oil-trade/

Ref #11: https://www.rt.com/business/575723-argentina-brazil-dollar-trade/

https://gettr.com/user/edwarddowd

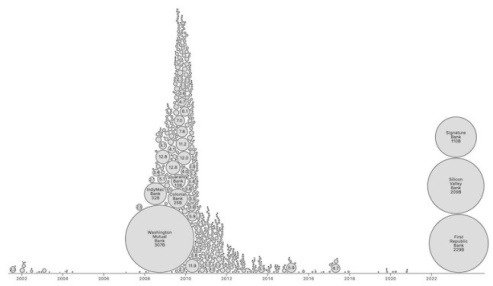

The current situation is already just as large and bad as the 2007-2008 Great Financial Crisis. JPMorgan has taken over The First Republic Bank while it´s actually ranked by regulators as the riskiest bank in the United States. And about one quarter of the entire FDIC deposit insurance bail-out fund has already been spent for the time being only to save three regional banks as we now see the crisis spreading larger and further. Now central banks find themselves running desperately behind events, something which no additional forward guidance of theirs (read ‘lip service’ ) can solve or help to solve. What actually happened is that after intense (close to 0 %) and extensive QE during many years the US Fed painted itself into a corner out of which it is impossible to move. Just like the warning in the Hotel California lyrics “You can check out any time you like but you can never leave”

“ Too Big for Fed: Have Central Banks Lost Control ? “

Ref #12: https://www.counterpunch.org/2015/11/25/too-big-for-fed-have-central-banks-lost-control/

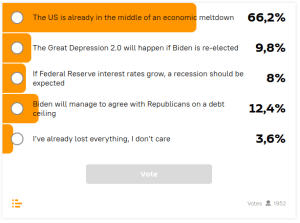

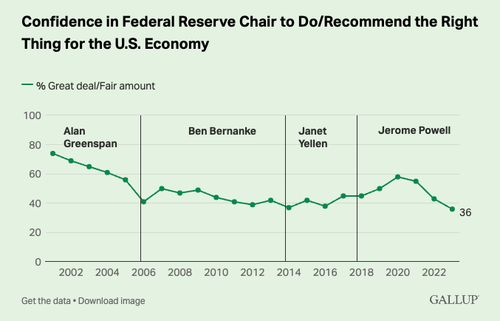

Two thirds of Americans today are aware of the possible US meltdown (Sputnik) and do not trust the US Fed (Gallup).

What would your answer be if interviewed by both polls ?

So this anlaysis is not about what Western interests — especially American — may or may not do but rather about how and possibly when the post-WW2 hegemony of the US and Western Empire will fail. The subsequent status and dynamics of whomever´s dominance may arise in the aftermath is fully unbeknownst to us today. So the focus of this article is not about what the Western Empire will decide to do but rather what is inevitably happening already to the Empire per its own doings. Of course, G7++ savers will try to end up with as many assets as possible by ASAP exchanging their currency (not “money” really) for tangibles as long as it is still accepted. But it would not be under the umbrella of the current G7 Empire´s dictates because it would just cease to exist. It would all be under a different “system” that we cannot yet grasp. And “others” elsewhere with their own “money” (not really) will try to do the same.

So the Western G7++ Empire most probably will collapse sooner than we may think and accordingly it will be left without its assets. For example, NATO and US Fed and other central banks would fade away ASWKT today. The US dollar would cease to be the ´de facto´ world-reserve currency. Global South and ROW would at least partially repudiate their US-dollar foreign debt or drag their feet for partial payment with no significant consequences pretty much. So the Empire will not get or have the control of the ROW + China, Russia and others in order to continue to exploit the resources it badly needs to survive. That´s the Western Empire´s unsolvable problem, and TPTB know it.

breaking news and fresh data from David Stockman at https://internationalman.com/articles/david-stockman-on-the-federal-reserves-great-pause-and-what-happens-next/ ” % Stock Price Change Today/From Recent Peak: PacWest: -50%/-93%; First Horizon: -33%/-55%; Western Alliance: -40%/-84%; Zions Bancorp: -12%/-73% In all, this batch of plummeting regional banks posted a combined market cap of just $10.6 billion at last Thursday’s close,… Read more »

Yes, Jorge what a great link from Mr Stockman! It also answers the question of where the flow of the multi-billions of deposit flight goes after it enters the money markets. This is all about the Repo market which actually died in August 2019 when all of the banks lost… Read more »

Colin, you should be interested in Ed Dowd´s take per ” When you take your money out of the bank and put it in a money market fund and they buy commercial paper or a treasury it doesn’t affect money supply. If that money market fund parks the money at… Read more »

Yes, Jorge, there is so much crap spun in regard to liquidity and money supply depending on who’s doing the talking. No wonder Yellen the White House puppet and Powell the keeper of the privately owned Creature from Jekyll Island fight tooth and nail. This also brings in the $42.22… Read more »

Colin, I agree with everything you posit 100%. I will replying to you with certain depth and detail very shortly. Please bear with me I can´t go any faster right now ! For the time being though this below please find the very latest on Zimbabwe´s attempt to fight off… Read more »

Colin, to answer your specific question some most knowledgeable people regarding gold suppression I know are Chris Powell at http://www.gata.org with the motto “Just where is our gold” + Ronan Manly + Andrew Maguire + Craig Hemke + Ed Steer + Alasdair Macleod + Eric Sprott + Ted Butler +… Read more »

Ron and Rand Paul (father & son) both US Senators have requested many times — and being denied — to audit the US Fed (supposed) theoretical gold holdings anywhere. From the US side NOBODY will ever approve any audit because they already know the answer. The only hope is Europeans… Read more »

All good Jorge. I’ve done that suggested reading and I agree pretty much with the commentariat. Macleod, Maguire and Hemke are some of my favourite commentators. The only thing I would add is that the true buying power of gold has remained pretty constant for at least 2000 years and… Read more »

Excellent work Jorge!… beautifully laid out and illustrated. As you point out, everything is moving so fast now it is extremely difficult to keep up – of course, the key players are having the same difficulty. I’m agreeing with you 100% and simply offering up a few more juicy morsels.… Read more »

BREAKING NEWS… literally! Did Wolf based at the West Coast ground zero funny money capital finally flick up that the feral funds rate might actually be fuelling inflation rather than taming it? He even supplied us with a chart to illustrate how patently slow he is. Newsflash Wolf – both… Read more »

Congratulations Colin, your correct analysis on Wolf is shared and discussed at

https://www.nakedcapitalism.com/2023/05/the-feds-interest-rates-are-still-fueling-inflation-rather-than-dousing-it-and-people-getting-used-to-this-inflation.html

Thanks for the heads up Jorge – I just went there and commented too. I notice that there are still a significant number of commenters around that cling to the view that further hikes could help alleviate this problem. Of course, it won’t, and even if the terminal rate stayed… Read more »

I agree that Ed Dowd’s excellent and now fully proven research on permanent toxic Spike Potein disabilities from the ultra massive mRNA clot shots will necessarily have a most negative impact upon manpower and the US economy at large, both right now and even growing into the future.

Jorge – It looks like Nakedcapitalism is carrying water for Wolf – they binned my two comments.

I am not surprised. YS + LS do that all the time even (or most specially ?) if you were the author of an article taken from somewhere else that NC were RE-publishing. So go figure.

Excellent input Colin with many important questions & conclusions, including: (1) “…this all begs the question – where the hell is all this money going…” It better not go (even partially) to buy stuff or consumption because that´s exactly what I am trying to describe, namely hyperinflation. (2) “…the notional… Read more »

So just like that – casually – Nixon shut down the established gold parity of 35 dollars per ounce at the time which today is officially ´valued´ by the Fed at USD $ 42.22 per troy ounce compared to a market price of more than $2,000. I know there are those… Read more »

Yes FC, the Treasury´s balance sheet has it that the supposed (with no audit in 78 years…) US gold holdings of 8133 tons held at Fort Knox or wherever (actually absolutely nowhere I believe) are valued at USD $ 42.22 per ounce troy while the current market price with enormous… Read more »

FC, this is not about me, okay ? So I try to be as objective as humanly possible. But now that you ask about it directly, I dare to recommend you read a couple of articles linked below that I published at The Saker site last year with Amarynth as… Read more »

Jorge Vilches, there is a simple way to save the Empire, a hostile takeover of the assets of Russia and then later China, Iran etc. Force the rest of the world to accept as many dollars as America wants to print. A global protection racket with the threat of, then… Read more »

We shall see what will end up effectively happening, archeon. But I do agree with you 100% that ” each day NATO gets closer and closer to the point of no return.” Then they better know what they´re doing, just sayin´

breaking : PacWest deposits declined about 9.5% during the week ended May 5… so Pac West shares crash.

https://www.zerohedge.com/markets/pacwest-shares-crash-after-reporting-deposit-flight-accelerated-last-week

https://www.zerohedge.com/markets/deposit-outflows-continue-foreign-banks-bleeding-most

This is my most favorite sentence: “Global South and ROW would at least partially repudiate their US-dollar foreign debt or drag their feet for partial payment with no significant consequences pretty much.”

I’ve been looking for the signs.