The “Bloody Shakespearean” commentary on Michael Hudson’s interview with Ben Norton

With thanks to our writer, Jorge Vilches

Michael Hudson and I know each other somewhat and both share deep mutual respect. But we are not really “dear friends”, at least not in the Latin-culture sense which translated would mean we do not have a “family-type friendship bond ” or something to that extent. We haven´t ever met personally either and in-depth analysis of anything has been restricted to less than a half-dozen Skype meetings years ago concerning Michael´s book “ Killing The Host” and that is about it. And although our intellectual roadways have occasionally crossed with comments from both while touching upon the same topics, we are not really ´colleagues´ because we belong to completely different ´leagues´.

In the best of cases some well-intentioned analysts may consider myself to be a reasonable student of whatever I decide to investigate. While Prof. Hudson – as humble as he is – obviously has a very well-earned miles-high standing in comparison. Of course, I also admire Michael Hudson because of his tenaciously valid and decades-long trajectory of prolific analysis and rock-solid conclusions. In comparison, I have absolutely no credentials and I am no match to MH either from the historical and/or financial perspectives, both of which are undoubtedly within his very well-acknowledged fields of expertise.

Still, as a dutifully focused and challenging student of history and finances, I very humbly dare to comment upon Prof. Hudson´s recent presentation on “How 4 US banks crashed in just 2 months”… and many more to come…in his dialogue with Ben Norton here at the Global South website. And my “kamikaze” commentary is no more and no less than two-fold, both from a historical and also from a political perspective.

Please be advised that in medical terminology I consider the current financial situation to be “terminal” both for the US economy and the US dollar which will necessarily also have tremendous impact upon the rest of the world… possibly both negative and positive. And my interpretation is that Michael Hudson did not say – or imply — that same concept at least in so many words. But I certainly do, and what MH discusses and correctly describes in financial terms I believe will necessarily lead to such terminal political debacle, although apparently he may not agree. And that´s my point.

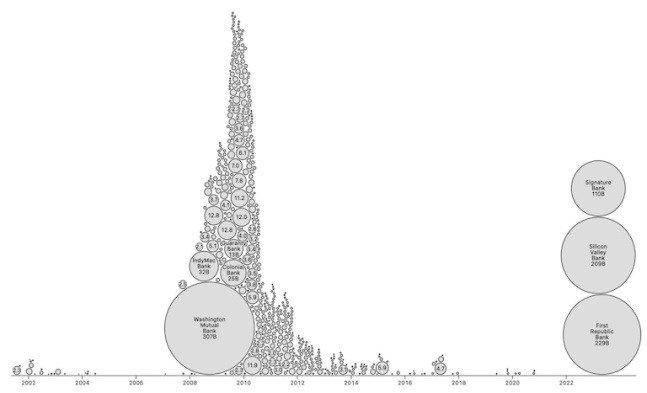

Ambrose Evans-Pritchard along these lines says lots in his “The Telegraph” – May 2 article with the title “Half of America’s banks are potentially insolvent” with the twin crashes in US commercial real estate and the US bond market thus leaving $9 trillion (Nine TRILLION dollars) uninsured deposits in the American banking system. Of course, with the current weak bank oversight, via e-banking facilities worldwide such deposits today can vanish in a matter of hours – also known as a ´bank run´ — with (almost) nowhere to hide. Most especially now that everybody knows that these “banks” currently have assets worth far less than their liabilities. Furthermore – and Michael would definitely agree with this — the signs of current worldwide de-dollarization are all around us now. So the Fed today has to either “try” to save the US banks or “try” to save the US dollar, but not both. It´d be mission impossible and no real tools available to do either, so it could very well be that both the banks and the dollar suffer the same fate. Please check out this article of mine published 8 (eight) long years ago namely ”Too Big for Fed: Have Central Banks Lost Control? ”

So in the above-referenced piece Michael concludes that, per the current US financial situation and the Fed-induced policies, US banks will end up consolidating into half a dozen ´too big too fail banks´ (sorta) to be openly and indefinitely supported by “the system”. In Michael´s own words he correctly believes that “… these are still the most troubled banks of all, except they have a government guarantee — just like Obama gave them — that no matter how much they lose, they will not lose any money. No matter how much the banks lose in negative net worth, it´s the economy that will lose (emphasis mine) not the banks. All of that became implicit when the Federal Reserve decided to help the banks that were insolvent in 2008 and 2009, to help them recover their net worth by quantitative easing…

Well, as long as interest rates were just about zero, you had free credit and you had a debt-fueled stock market boom, the biggest bond market boom in history, and a real estate boom.” But then the Fed … “decided that it was going to begin raising interest rates from 0% to 4%… with securities and mortgages and bonds that pay a very low interest rate so their price fell by 30%, maybe even 40%…” … “(So) just about every bank in the country moved into a negative equity position because all the banks have made fairly long-term loans.”

So agreed that the Fed created a $9 trillion worth of Federal Reserve balance sheet support of the banks to enable them to drive down interest rates to almost near zero, i.e. 0.1%. And I say that under current circumstances this necessarily means rampant inflation with direct impact on CPI which middle-class consumers will have to (supposedly) pay for where it hurts most in daily expenses. But I also say that this will not happen this time around. Let me explain.

So my commentary on Michael’s analysis is in historical terms, namely Shakesperean in that in “The Merchant of Venice“ money-lender Shylock — although entitled to a pound of flesh from Antonio – in the surgical process he still was not allowed to shed a single drop of his blood. And per my humble analysis that would be Michael´s “bloody Shakesperean” outcome as lots and lots of blood would be shed by a massive amount of people both in the US and also worldwide thus triggering an absolutely uncontainable revolution. Why so ?

Well for two good reasons I believe. Reason #1 is that only middle classes anywhere save US dollars so in this case it would be dozens of jeopardized trillions of dollars ´owned´ by many hundreds of millions of middle class members. And Reason #2 is historical: any and every single transforming revolution in the history of mankind has been made by middle classes not by rich people and not by the poor as many would have us believe. It´s always been the middle classes pushing for change, not anyone else something with which I imagine Prof. Hudson would surely agree.

Shakespeare expert Dennis Abrams goes further adding that “(for) Elizabethan audiences living in a period of heavy inflation and soaring debt, Antonio’s looming sacrifice must have seemed a particularly vivid metaphor for those real-life debtors who were sent by bloodsucking creditors to notorious London jails such as Newgate and Ludgate. And the insistent sacrificial metaphors for Shakespeare’s play begin to seem frighteningly real as Shylock’s demand reaches a fever pitch.” https://theplaystheblog.wordpress.com/2012/07/12/shed-thou-no-blood-nor-cut-thou-less-nor-more-but-just-a-pound-of-flesh/

https://gettr.com/user/edwarddowd

The current situation is already just as large – and as bad — as the 2007-2008 Great Financial Crisis. JPMorgan has taken over The First Republic Bank while it´s actually ranked by regulators as the riskiest bank in the United States. So imagine. And about one quarter of the entire FDIC deposit insurance bail-out fund has already been spent for the time being only to save three regional banks as we now see the crisis spreading larger and further.

Michael Hudson adds that… “the government (now) says that no bank depositor, no financial investor will lose any money. We promise you that the economy will lose money, not the banks, not the financial sector. We promise you that if we have to pay more money to support the financial sector, we’re willing to cut back Social Security. We’re willing to get rid of Medicaid and Medicare We’re going to get rid of social spending because the economy needs the banks not to lose any money, because to us politicians they’re our campaign contributors. They’re who we really work for and protect. That’s our job as politicians.”

I say instead that middle classes will realize – and suffer – what MH correctly describes… but will not accept it.

MH says :… “ The government has said that no matter how much money the banks lose, even if Chase and Citibank are insolvent, because after all, they also hold long-term mortgages and long-term loans and long-term securities. But no matter what, we’re going to create enough money to bail them out…. And the economy will lose money…” so be it to the tune of 9 Trillion dollars… but I say the middle class will not politically accept that because as Michael yet again correctly foresees… “… all of this is unsustainable, and we’ve reached the point of unsustainability…” with essentially the government itself and indirectly its so-called “regulators” working for the banks and against middle classes. “ The existing financial system cannot survive in the way that it is now structured, because it makes any increase in interest rates drive banks insolvent. And the government has said “ We’re not going to support the small banks, we’re not going to support the local commercial banks or the smaller revenue banks. They’re not our campaign contributors.”

I say middle classes this time around – with everything to lose — will not put up with such nonsense either.

“ So the government has basically announced, if you want to keep your money safe, move it to one of the five big systemically important banks. ´Systemically important´ means that it’s a bank that controls government policy of the financial sector in its own favor…. And you want to be part of a system where the banks in which you have your deposits are in control of who gets elected in government to appoint who becomes the Federal Reserve regulator and the various bank agency regulators.”

But then Ben Norton points out in the same interview that “… The four big banks that contributed the most to try to save First Republic Bank — the ´systemically important´ banks — have 58% exposure to $247 Trillion in derivatives…” To which Michael Hudson responded “ The Treasury Secretary’s job is to protect the big (American) banks… just like it did with the case of Greece” a few years ago.

I say that US middle classes might not have moved a finger to avoid Greece and the Greeks from going under… but there will be blood in the streets a-la-The Merchant of Venice if this time around it´s THEM that get to lose, in many cases everything. Perils, discomfort, mishaps and wars are okay if far away from the US middle class territory, but NOT in my back-yard.

Michael adds that the Secretary of the US Treasury thinks pretty much that …” just as we’re supporting an unsupportable loser in Ukraine, we’re going to support the unsupportable losers, seemingly, in the American banks. We will do whatever it takes so that the big banks do not lose money, even though they’ve made a bad bet, a bet that would have lost all the money, a bet that would have left them insolvent, a bet that would have led them to be taken over by the FDIC and turned from a private bank into a government bank.”

I do not believe that US middle classes will put up with that this time around either.

MH adds: “ So the bottom line is that the whole U.S. economy is being sacrificed to banks that have made bets.

So if there are only four or five systemically important banks — meaning banks that we’re not going to let go under — and no matter how much they lose, you won’t lose your money in these banks, well, that means, hey, folks, take your money out of your local bank and put it in one of the big banks, because they’re now running things.”

I say many/most middle classes will not be quick enough to move their “money” around from their current banks and thus will get caught. There will be blood in the streets.

MH responds by saying… “But for the bank depositors and for the public to be quiescent, they have to be stupid”

But I do not think that this time around they´d be THAT stupid simply because – I repeat – there should be 1930-style blood in the streets, or maybe worse than that.

I have no technical objections or disagreement with MH on issues regarding finances or economics.

I do have a different political outlook and, of course, my guess is as good as his.

In conclusion, please allow me to leave on record my unlimited respect and gratitude to Michael Hudson, a brilliant historian and experienced economist also author of many best-selling books which we, and I, have all enjoyed and learned lots from.

—o0o—

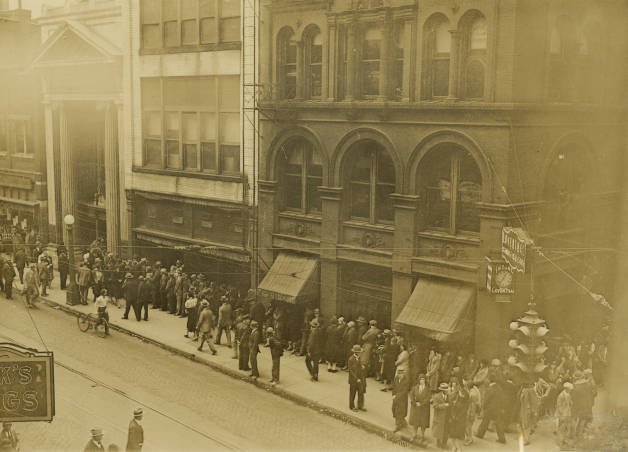

Featured Image: Bank run on the Tennessee Hermitage National Bank, 1930 November 14

With the greatest respect to the fine writing and writers above, you need to turn that telescope around and look through the small hole at the other end. This is not about what Western, especially American interests may or may not do. Start at the end and work backwards. Who… Read more »

Your point is well taken, archeon. From my personal perspective I fully agree that this debate should not be — as you correctly say — ” about what Western, especially American interests may or may not do”. Methinks this debate is about HOW and WHEN the post-WW2 hegemony of the… Read more »

Jorge Vilches, your reply was more generous than I deserved, thank you. Your article sparked a substantial debate and got us all thinking, may there be many more. The bailiffs are coming, first they will auction off anything of value for pennies on the dollar/pound/euro. Then they will change the… Read more »

THE CENTURY(S) OF HUMILIATION With all due respect Archeon, if China “wants Canada and Australia” then this would immediately bring into question the entire spirit of the peaceful and cooperative, everyone-wins vision, of the entire BRIICS+ and BRI initiatives – FOREVER! If this really was part of their agenda, then… Read more »

Colin Maxwell, Canada and Australia both have 25 million citizens with vast but untapped natural resources due to inhospitably climate and poor governance. China has the experience of building infrastructure, the wealth and excess population to change all that, imagine Australia with an additional 25 million Chinese immigrants. You have… Read more »

WHILST ON THE SUBJECT OF BANK RUNS https://wallstreetonparade.com/2023/05/academic-study-finds-that-one-of-the-four-largest-u-s-banks-could-be-at-risk-of-a-bank-run/ … quoted… “The systemic threats to the U.S. financial system were not remedied when Congress passed the watered-down Dodd-Frank financial reform legislation in 2010. While that has been evident with each Federal Reserve bailout of the mega banks and their derivative counterparties,… Read more »

Colin Maxwell, your very specific and tremendously valid input is highly appreciated. Your timing was perfect. Thanks again “farmer from NZ” !!

Thank you for your very kind words, George. Notice too that as utterly sobering as the news was, the four academics did not factor in another huge gorilla – in their risk assessments they completely ignored the giant derivatives books that these banks hold. Perhaps these habitual bastions of the… Read more »

Two thirds of Americans today do not trust the US Fed.

https://www.zerohedge.com/markets/americans-confidence-jerome-powell-sinks-inflation-batters-households

Yes, George – a bedraggled procession of kleptocratic shills and barefaced liars who fail upwards – all the while constantly gutting the productive sector of the US economy, along with a massive chunk of the global financial scene as well. To even consider for one moment that the Fed have… Read more »

Apologies not George, JORGE!

Col, if that were all… (joke)…

Actually I go by either Jorge or George (or Georgie) or even Georgio (Italian) and this last one please don´t ask me why !!!

Not exactly what we are discussing, but close enough .. Sputnik is running a poll with the question “Do You Think US Will Dodge a Major Economic Crisis?” https://sputnikglobe.com/20230502/poll-do-you-think-us-will-dodge-a-major-economic-crisis-1110030735.html The poll is not done yet but one can already see the results ..

The Sputnik poll above indicates results that would fully contradict the lack of awareness assumption. Two thirds of the people polled acknowledge a “US economic meltdown” So personal impressions do not matter much simply because, as such, our “personal” impressions are limited to a very small number of people with… Read more »

Thinking about Michael’s comments in the interview and Jorge’s comments in his article, I selected that image of the bank run on the Tennessee Hermitage National Bank, 1930 November 14 very carefully. Is that the middle class or something that is representative?. See how docile they are? Standing in a… Read more »

Amarynth, I have just seen your comment above and off the cuff two comments come to mind. No. 1 is that the photo you selected corresponds to the bank run on the Tennessee Hermitage National Bank, 1930 and right now it´s almost a century later, entitlements are rampant and the… Read more »

I’m going to remain a little bit on the fence here and mainly comment on the sociopsychological picture. We still have family (in-laws and brother and sister and cousins) and I do not see even one of them revolting about financial stuff. About all other woke issues yes, and the… Read more »

Amarynth, the reason you do not yet see ” even one of your family members revolting about financial stuff ” is because their money is still in their bank accounts. The instant they do NOT have 100% of it any longer, all the descriptions about Argentina and elsewhere will sink… Read more »

I also agree with The Farmer from NZ´s post above in that ” something like 35 US states are making strong moves to transition into sound money and public utility banking models “. Furthermore the Col. says — and I agree – that he ” sees more momentum in this… Read more »

Great comment amarynth. Another powerful reason Americans don’t revolt is because they don’t want to disrupt any chance for them to get rich, even if those chances are dysfunctional or even immoral.

eeyores enigma, Amarynth

The West´s business model now finds itself between economic collapse and deep political and civil strife and/or civil war. Please check out this link at

https://dailyreckoning.com/the-collapse-of-the-wests-business-model/

Although I linked to and excerpted some of the interview, no real discussion ensued at Moon of Alabama despite it being filled with Hudson followers. We had a bit more today, but mostly Big Picture stuff dealing with Global Fracture (again) into Dollar Bloc and RoW Bloc. We did interact… Read more »

Very well said Karlof1!

Your last two sentences hit the nail on the head fair and square.

Awesome work again Jorge… great to have you here with your very welcome southern perspective! I would tackle this question about the existence of the middle class by revisiting my point #4 in a recent comment I made on USA Watchdog which I will copy and paste below… (it seems… Read more »

Jorge, you’ve done it again, nice work.

Steve, the idea is the wider and deeper and the more open the debate is, the better for all. And also I can´t be 101% sure of everything I may affirm either. Please do challenge anything I may say and how well I can ( or not ) sustain my… Read more »

“Open debate — better for all.”

Exactly. I was going to mention that but it slipped my mind — I was over-excited being in a discussion with two great minds !

Well, Jorge’s disagreement with me boils down to whether the middle class (does it really exist?) will revolt against the unfair economic system. That is indeed the political crux. He’s writing from Argentina — and by the way, he was quite helpful to me a few years ago in explaining… Read more »

“the only sign of their doing this is for them to buy their own gold.” Yes, I’ve thought for some time that one way bring down the system without bloodshed would be for enough people to quietly withdraw from the system, by setting up co-ops etc. But withdrawing from the… Read more »

Steve, for the record — and maybe I should have made this crystal clear — by “blood in the streets” I did not intend to mean that literally… although some violence cannot be discarded. What I meant by “blood in streets” was deep losses that most people (savers) would not… Read more »

All OK Jorge, I did not have your comment in mind. Many believe that there must be bloodshed to achieve reform, and in many cases that’s correct, but not all. Withdrawal from the system might at first glance seem futile, as there’s a limit to how far an individual can… Read more »

Hi Steve – yes something like 35 US states are making strong moves to transition into sound money and public utility banking models, Both initiatives will be needed to come out of this meltdown with any semblance of order. But, IMHO as admirable as these initiatives are they will be… Read more »

Old mate, I hope I live long enough to see that !

Hi Michael Wonderful to see you interacting here! I thought I would take this opportunity to say what a huge fan I am of all of your work, and to acknowledge what a profound privilege it is for myself, down here in the South Seas, to be able to guest… Read more »

Dear Michael, fancy meeting you here with the most pleasant surprise of your response certainly an excellent way to deepen the debate with yet more valid food for thought. This Global South website might be the columnist´s Vatican but with your added fine company Sir it´s like conversing with the… Read more »

I would agree if it were any other country other than America. Americans are the most lied to and ignorant population on the planet. They literally ask to be lied to and at this point it doesn’t even have to be a good lie. Also if it gets really bad… Read more »

eeyores enigma, thanks for contributing to this (open) debate. I see your point (sorta) but the difference this time the middle class debacle will not need any MSM coverage at all, no Sir. It will be “screen desperation” when the Karens and the Kens desperately see their “money” isn´t in… Read more »

Furthermore I hasten to respond that this time around the negative impact of this ´banking & US dollar´ double-whammy crisis would be felt all around the world — and not just America — anywhere that dollar-saving middle classes are found. So imagine many trillions of dollars dissappearing or de-valuing sharply… Read more »