“5 Months Left”: Celente Warns of Economic Collapse

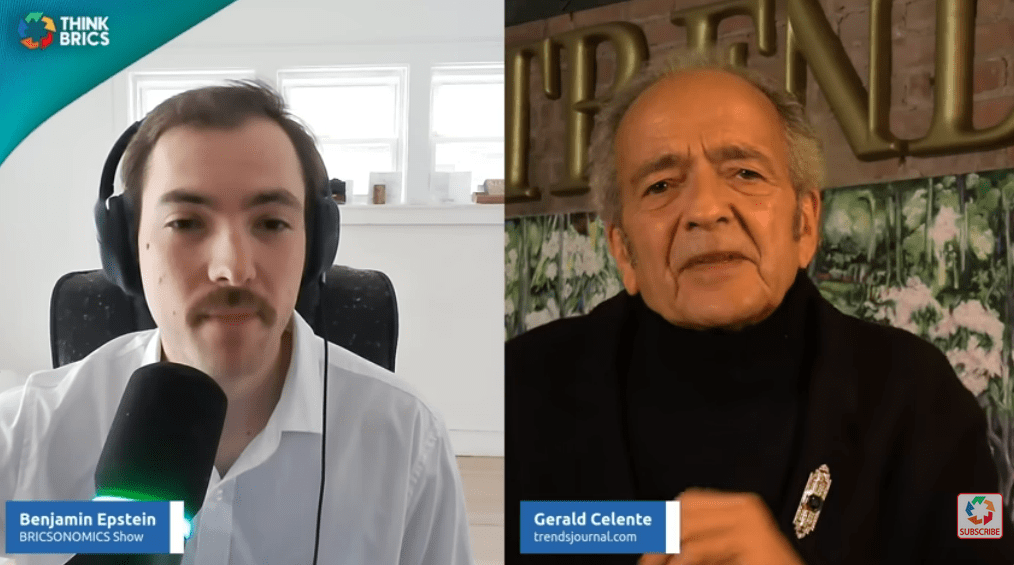

The global economy is cracking faster than most people realize—and the next five months could determine everything. In this explosive interview, Gerald Celente of the Trends Journal breaks down why the economic collapse 2026 narrative is no longer distant speculation but a rapidly unfolding global economy crisis.

Celente explains how the US debt crisis, runaway deficits, and mounting economic uncertainty are colliding with geopolitical tensions, including the escalating Iran conflict and broader Trump geopolitics, to push the world toward a financial markets crash. He details why rising gold prices forecast and silver price prediction signals matter now, positioning gold as a safe haven amid fears of US dollar collapse, accelerating de-dollarization, and the rise of BRICS nations and a potential BRICS currency—a core focus for those who think BRICS.

The discussion connects the bursting AI bubble to a modern dot com bust, warning that a cascading financial crisis and global recession could follow. Celente also outlines a sobering World War 3 prediction, the impact of surging oil prices, and why the China economy forecast plays a decisive role in reshaping global power. Finally, he addresses the growing Gen Z revolution, rising political unrest 2026, and how a system under strain has failed the next generation—fueling social and economic backlash worldwide. This is essential viewing for anyone concerned with precious metals investing, systemic risk, and the future of the global order.

This video does not provide personal financial advice, specific stock picks, crypto recommendations, or short-term trading strategies. It does not offer guaranteed timelines, survivalist tactics, or sensational speculation disconnected from data. You won’t find step-by-step investing tutorials, portfolio allocations, or predictions based on insider information. Instead, the focus remains on macro trends—financial crisis, global recession, US dollar collapse, de-dollarization, BRICS nations, gold as a haven, and long-term structural risks—grounded in historical pattern analysis from Gerald Celente and the Trends Journal, not hype.