Trump is powerless to stop DEDOLLARIZATION

Trump is powerless to stop DEDOLLARIZATION

New economic realities and technologies will make the greenback OBSOLETE. Tariffs are totally INEFFECTIVE against these changes

Let’s start with a brief history lesson.

Before the US Dollar, the British Pound was global reserve currency.

But in the late 19th- early 20th century, the US overtook Britain as premier manufacturing and trade power.

This enabled US Dollar to overtake British Pound after WWII.

What has happened over past 30-40 years?

China has overtaken the US as the world’s manufacturing trade powerhouse.

China will also likely overtake the US as the world’s largest economy by 2030-2035. It has already surpassed the US in terms of GDP PPP.

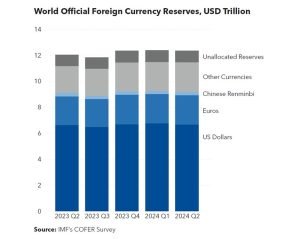

Despite China’s economic rise, the US dollar remains OVER-REPRESENTED in international reserves and trade settlements.

US dollar accounts for 58% of international reserves and 54% of global financial invoices.

This allows US to borrow exorbitantly from overseas.

China currently doesn’t have the ability or political desire to replace US dollar system. But China is working to pioneer digital currencies which will dramatically cut transaction costs for international trade financing, while also strengthening transaction security.

Blockchain technology makes it possible to track a product’s journey from factory floor to final shipping container It also enables real-time logistics by optimizing delivery and payment schedules In other words, huge efficency bump!

https://x.com/i/status/1890390799143018986

China’s digital currency innovations are coupled with its automation boom China is using big data and robots to usher in a “smart logistics” revolution This is why the Digital Yuan will have an advantage over any US or European digital currency.

China’s new model of “smart logistics” and digital payments will reduce the working capital used in international trade. This is bad for the US because much of the working capital in international trade is invested in US money markets or government securities.

Let’s summarize:

China’s growing economic clout + digital payments/smart logistics revolution will significantly reduce offshore dollar deposits.

This in turn would cause a drop in foreign holdings of US securities.

This in turn would lead to a US financial crisis.

In fact, de-dollarization should not be an end in itself, but a good side effect. What you would want are alternatives that are better than the dollar, better for people, trade and countries. Starting from your own strength and making sure your product and service is good for you and… Read more »

The USD is already a weapon and has had more negative effect on the planet than anything you or I could conjure up individually. I see de-dollarisation as an opportunity for the USA to become an ordinary citizen of the world not as a negative. it will be difficult for… Read more »