eCONomics Part III: Banking 2.0

A New Global Trade Currency Paradigm and the End of the Era of Dominant Western-based Fiat Currencies

With thanks to our own Colin Maxwell of New Zealand.

Please read in order: Part 1 ; Part 2

Preamble

My apologies in advance to the vibrant GS community for Part III being so wordy. I have really struggled with this task, as the entire subject is so monumental in all of its interconnected elements.

To try to avoid it becoming too tedious I have broken it down into multiple chapters to try to make the weight of the subject matter a bit more palatable, and to hopefully avoid losing readers within the first few paragraphs.

None of this is intended as gospel or sermon, but simply as a discussion document that endeavours to pull together as many of the current contrasting thought threads as possible.

It is also part of my own personal intellectual journey, and extremely steep learning curve. I learn the most by writing on subject matter like this.

Critique and suggestions are very much welcomed.

1. Operation Sandman – to use or not to use?

In 2022 the Saudi MOF revealed in a WEF/Davos interview that ‘Operation Sandman’ was activated and that the KSA would now gladly accept all currencies for settling oil transactions.

The theory was that when it is properly launched, at least 100 countries would conduct a coordinated sell off of their trillions of dollars worth of US government debt to break the U$ dominance of the global economy. This would immediately open the door for a completely new financial hierarchy.

According to Stephen Jen, CE of Eurizon SLJ Capital, the share of global reserves held in U$ dollars eroded in 2022 at 10x the average pace of the last 20 years, and stood at 47% – a much lower estimate than that of the IMF. This represents a plunge, especially in relation to the 15 year trend.

Multiple factors include…

- Gold being declared a Tier 1 asset under Basel III rules from January 2023* – although this intention was announced right back in 2012 in the Lehman aftermath

- Digital currencies

- Strong political elements including the US-China relations worsening

- Avoidance of future sanctions

- Avoiding reserves being stolen

- Aggressive interest rate hikes by the U$ widening the gap in exchange rates between other countries and the US

<< *This was effectively a move from Tier 3 class for commercial banks holding it as an asset on their balance sheets. The BCBS (Basel Committee for Bank Supervision) is arguably the highest global authority on banking supervision, with the key role of defining capital requirements.

Ironically with the latest developments with the BRICS+ bloc and the revelations of just how precarious some of the Western fiat countries are in being underpinned by their ability to sell government bonds, the new physical gold Tier 1 designation could really put the skids under this entire fiat edifice.

Prior to this new ruling, banks were very much dis-incentivised to hold gold, and instead to hold risky assets such as equity capital, currencies, and debt instruments. IMO opinion the fiat currencies carry significant risk already, let alone when the new hard backed BRICS+ instrument comes into play. >>

This erosion of support for the existing reserve main currencies will inevitably lead to…

- Lower stock prices

- Higher bond yields

- More expensive imports

- The US geopolitical standing taking a big hit

2. Why I doubt that Operation Sandman will be invoked…

a crucial historical review

It is a pointless exercise and counterproductive for the entire planet, including the BRICS+, and the RoW to do this in unison. They can all simply gradually dedollarise by stealth, and in doing so maximise the benefits whilst transitioning in an orderly fashion.

Besides, the US is massively naked shorting gold anyway, in the vain hope of hiding the massively eroding purchasing power of king dollar. This is a godsend for the RoW central banks – the US is idiotically accommodating their rival’s gold bullion stacking binge at massively discounted and contrived synthetic prices – they must be laughing all the way to their central banks.

For more than half a century, since Nixon took the dollar off the international gold standard, all currencies became fiat. Prior to that event, they all were hard backed and most of all by that barbarous relic, gold. The way things are panning out the 50 year experiment of a non hardbacked reserve currency is coming to a close very soon. In the context of some 5000 years of financial history this is barely a drop in the bucket.

Essentially, from 1971 on, there was a divergence of investment in the U$, and many other Western financial systems, away from the industrial capitalism of the real world economy, into what would turn out to be ruinous financial capitalism. Surely fiat currencies, coupled with a greedy obsession with financial rentier capitalism, is a guaranteed recipe for disaster.

3. Is The U$ Pinning its Hopes On Discovering Alchemy?

Europe’s tiny central bank gold holdings are probably accurate and likely not rehypothecated to any great extent, but the same cannot be said for the US’s claimed 8133 tons of US gold holdings.

It is almost certain that there are multiple ownership claims on each ounce, and this is why global central banks are quietly repatriating physical bullion. The same with silver, as the paper claims for each physical ounce are at least 90:1. The silver price discovery market is even more broken with the true G:S ratio needing to be more in the realms of between 8 -16:1.

Texas is very wisely building its permanent state depository and recategorising gold as legal tender. They do not trust the centralised system, and now at least six other states are looking to follow their lead, because they too are losing trust in the federal system, and in the management of US Treasury gold.

If Texas doesn’t trust the U$ system, then why on earth would the RoW?

4. Foreign Exchange Reserves Quietly Converted Into Gold Bars

It turns out that the massive global shadow banking industry, and with gold being auto-categorised as foreign exchange reserve, that this combination has hidden the fact that large swaths of foreign exchange reserves are being converted into physical gold.

This trend dates back to at least 2010 but really ramped up when the US weaponised the dollar in March 2022 with Russia’s SMO in Ukraine.

This makes a ton of sense (literally) for the RoW, as it amounts to de-dollarisation by stealth – converting incumbent US dollar debt into stacks of debt-free bullion.

Furthermore, this sanction-proofs potentially trillions of excess reserves – a no-brainer when the entire globe is in such a state of financial and military turmoil.

Estimates are that China has around $6 trillion in excess FX reserves giving a truly staggering gold/GDP ratio compared to Europe with a pitiful 4% average and the US potentially massively negative.

Robert Triffin, Belgian-American economist (1911–1993)

5. Another new Global Paradigm — no national currency having the ‘exorbitant privilege’ of reserve currency status

indeed a first for humanity…

Why on earth would any country, especially China, want its currency to have overwhelming reserve currency status anyway? A very bright spark, Robert Triffin, predicted back in 1959 that the Bretton woods system, with the U$ dollar as the world’s utterly dominant reserve currency, was doomed because of fundamental flaws.

Triffin was right – the Belgian born Yale professor predicted that by definition a reserve currency would run increasing deficits. The more popular a reserve currency is, the higher its exchange rate tends to be and the less competitive its domestic exporting industries become.

This means trade deficits for the country issuing the currency. They love the effectively ‘interest free loan’ generated by selling their currency, or in essence their debt, to other countries, but at the same time they need to raise capital for dollar denominated bonds. This is part of the paradox – cheap sources of capital and positive trade balances rarely coincide.

6. Implications of Gold Backing – a national currency versus a trade only international instrument

History has proven that gold is inappropriate for domestic monetary backing. Michael Hudson covered this on page 433 of his epic book ‘Super Imperialism‘ quoted/paraphrased…

‘Freeing domestic credit from gold backing has been a precondition for promoting rising employment and production of goods and services. But in the international setting gold backing is a positive because it serves as a very real constraint on trade imbalances but not on domestic production and employment.

You could say that Europe and Japan abandoned gold prematurely before developing an alternative to the U$ dollar or the dollar-proxy SDRs issued by the IMF, as an effective arm of the U$ government.

Only the U$ has shown the will to create international structures, and to restructure them to fit its financial ‘needs’ as they devolved from a hyper-creditor to a hyper-debtor nation.

Removing the gold convertibility of the dollar enabled them to unilaterally pursue protectionist trade and cold war military practices simultaneously. The US claim that their surplus dollars act as a ‘growth locomotive’ for other countries by expanding their credit creating powers – as if they need US dollars to do this.

Meanwhile they were able to derail foreign attempts to break free from what has become a tidal wave of US deficit dollars. History will reflect on the remarkable asymmetry between the U$ and the RoW.” … end quote.

Of course public utility models, like the incredibly successful Commonwealth Bank of Australia, prove that assumption to be patently and tragically false, as this model went on to be arguably the most successful public utility equivalent to a reserve bank in world history.

7. The Commonwealth Bank of Australia — a Pubic Banking Utility Masterstroke

I have included this long chapter, because it is actually an integral part of this entire subject of eCONomics – which is to say that everything about neo-classical economics is based on false maxims and lies, designed to enrich the financial kleptocrats ensconced at the head of the human food chain.

This is integral because it illustrates the fact that in so many cases countries do not even need to borrow from abroad if they effectively deploy the PBS at reserve bank or treasury level. This is another key piece in the global jigsaw puzzle where the global economy could be transformed into a completely new egalitarian paradigm.

The public banking model in itself would become a huge source of liquidity and capital for the entire domestic economy. This would replace the status quo con where nations allow a parasitic global banking cabal to constantly thieve from them like a giant squid, sucking the lifeblood out of the entire nation.

This concept is extremely simple – it means that the public creates their own money and liquidity and to reap the benefits of any interest paid domestically, rather than third parties creating that money and subsequently allowing them to charge us as a nation for that privilege. In the current broken model, we annually allow billions of dollars to disappear overseas into these parasitic global banking institutions.

The exciting part of it all this is that incredibly successful public banking utility models have already been tried and proven to work, and to generate huge sustainable wealth for entire national economies.

One of the most stunning examples was the Commonwealth Bank of Australia which Ellen Brown details in her awesome book ‘The Public Bank Solution‘. Of course, history informs us of the tragedy that this incredible model didn’t last – it actually became a victim of its own astonishing success, and it was destroyed by the combined might of the parasitic global central banking cartel.

While the US was setting up its privately owned central bank, for the Federal Reserve, to become a parasite on the productive economy of most of the world, Australia was at the exact same time taking the bold step of establishing a PBS bank that issued credit for the sole benefit of – wait for it – Australians!

The huge irony is that Denison Miller, the bank’s first Governor, was allowed to try this model only because he was considered by the other existing bankers of the day to be one of their own thieving ilk, and that therefore they would be able to keep this new bank in line.

In essence, Miller understood how the commercial banks thieved from the nation at large and he set about creating this new model that could very rapidly revive a struggling economy and create long-term wealth for the entire Australian society. The first branch opened in Melbourne in July 1912 and Miller was the only employee.

Somehow he had persuaded the Treasury to advance him £10,000 as seeding money – the first and last time this version of the CBA was lent any money. Of course, this money didn’t even exist – it was simply created as a ledger entry.

Miller subsequently promised that the CBA would at all times be the people’s bank. It slowly dawned on the private bankers, who were so intent on having to guard against the socialisation of their own banks, that they completely underestimated the power of an orthodox banker who simply mobilised the resources of the entire country to enable the CBA to quickly grow into one of the greatest banking models the world had ever seen.

The bank began advancing massive sums of money simply on the credit of the Australian Nation. An early example was the Melbourne Board of Works which went to the market for money to redeem existing loans and to raise new capital – normally they relied on loans from the viper’s nest residing in The City of London. Instead, this time they approached Dennison Miller and were loaned £3 million at 4% – this was an enormous sum at that time.

In 1914 during WW1, citizens started rushing into their banks to withdraw their funds – Miller quickly put a stop to these bank runs by simply declaring that the CBA would support any banks in difficulty – that was the end of the panic immediately. It was a dramatic demonstration of the power of the Govt to stabilise the financial system without relying on any other parties.

In just 2 years from the creation of this bank, Miller was basically in control of financing Australia’s war effort and ZERO money was borrowed from overseas. It was the first bank in Australia to receive a Federal Govt guarantee and offered both savings and general transactional services. By 1912 it took over the State Savings Bank of Tasmania, and by the following year, it had branches in all 6 states.

In 1920 it began acquiring central bank powers and took over the responsibility of issuing Australian bank notes from the Dept of the Treasury. In 1924 a board was appointed with 6 members as the new governing body. During WW2 emergency legislation was passed and the CBA was granted almost full central bank powers.

The CBA was a remarkable success, but was subsequently seen to be threatening the hegemony of the City of London thieves. Prior to the establishment of the CBA, London capital had always dominated the Australian financial system.

This was the colonial model of the time – ie financial colonialism, where the colonies were granted the right to “govern” themselves – provided they obeyed the financial rules of the COL (City of London) – shame about this acronym!. As such the Old Lady of Threadneedle Street (The Bank of England) presided over the financial dynasty of the empire.

Australia was a debtor nation until WW1 when it suddenly demonstrated its ability to independently finance its war effort. It also used the CBA to finance its own shipping line which was poised to smash the City’s shipping monopoly – the old bitch from Threadneedle Street was not amused.

Miller calmly told the big bankers at a dinner in London that Australia could meet any demand, simply because it had the capital of the entire country behind it. When he arrived home in Aus he was asked by a deputation of the unemployed for a loan of £350 million for productive purposes – he advanced the money immediately, and news of this caused panic within the COL, as they realised that if other countries adopted this model their entire financial edifice could collapse.

The COL immediately set about devising a plan that would enable overseas national institutions to be drawn into its squid-like network. The plan was to centralise all banking throughout the empire over to the supervision of the Bank of England – it would become the super banker’s bank.

The horrible old lady got her way and as such the modern parasitic and hegemonic central banking model was born. The head of the bloodsucking squid would eventually moved from London to the Bank for International Settlements (BIS) in Basel Switzerland – a model originally designed to launder Nazi war loot pilfered from their rampage across Europe during WW2.

This is the disgustingly parasitic model that survives to this day, and New Zealand (NZ) is a paid-up member of this bankster club too – our RBNZ dances to their tune and as a result we squander billions of dollars annually overseas to thieving institutions when we could create our own money and credit just as the CBA did in Australia.

Sergey Glazyev, Russian politician and economist, with Vladimir Putin

8. Whats is the new BRICS+ Instrument to be – a basket of 20 commodities including gold, or gold alone?

Some very astute financial analysts, including Alasdair Macleod have thought all along that Sergey Glazyev, the Commissioner for Integration and Macroeconomics within the Eurasian Economic Commission, the executive body of the Eurasian Economic Union, was never that serious about the new trade instrument being backed by a basket of around 20 major commodities including gold and silver.

Their theory was that this multiple hard-backing would be too hard to bring to fruition and to administer. Personally, I always liked the idea because I thought it could have had a smoothing effect on the volatility of the trade instrument. This would be very much the case until the market discovery of G & S finally kicked in to properly expose the true purchasing power of the dominant Western fiat currencies.

Certainly though, the gold only backing could be easily instigated, with a brand new issuer of this currency that would not be taking a central bank style role, but to simply become an institute of issuance.

Gazyev has publicly written in a Moscow based business paper that it is time for the Russian rouble to be on a gold standard – given this was co-written by the deputy of the EUEA Committee, this must carry some weight, but it was written back before the Johannesburg BRICS+ Summit meeting, in which no decision or announcement was made about the new instrument.

Also at that time there were statements from Indian officials that there was no way they would go along with this gold-backed currency. Remember too that BRICS+ requires a unanimous vote for this new currency instrument to be accepted.

Also Lavrov has mentioned that Russia had accumulated a large quantity of Indian rupees which were difficult to convert – a new trade instrument would make the process of trade a breeze, and stop the third party ticket clipping too. No sooner was this intent announced than both the odious Yellen and Kissinger visited Beijing to try to pressure China from joining in this new initiative, presumerably using the argument that it would undermine their export market.

It appears that China is more concerned about the vulnerability of the new BRICS+ members stress arising from high interest rate loans, than they are about the welfare of the Western hegemon – who could blame them for that – the economic hybrid war waged against the RoW is hardly a secret.

Also the new trade-only currency is very different from normal bank credit, as this form of credit is self-extinguishing when trades are completed. I assume the importer would get access to the trade currency through its central bank. This would be credit created on the back of this new currency and tied to gold, not just created out of thin air.

Presumably this would make the politics a lot more simple because there would be no interference with the management of the individual member’s sovereign currencies. This also explains why the idea of the new trade instrument being just a mix of all of these currencies was probably a bad idea.

This system would also have required endless reconfiguring as a growing procession of new members joined up. I view the 153 BRI members as a precursor to a massive watershed of new BRICS+ members adding exponentially to the size of this new bloc.

Incidentally, the SCO (Shanghai Cooperation Organisation) and BRICS+ are becoming more and more aligned too, with the SCO having nine full members, two observer nations, fourteen dialog members and another six pending applications, giving a grand total of 31 nations as members and associates. Kuwait, UAE, Maldives, Myanmar and Bahrain are all new dialog members just since May 2023

9. China is under no illusions about the serial economic hitman antics of the Western financial hegemon

They have witnessed the Latin American (LatAm) crises of the 1970s US orchestrated pump and dump schemes that effectively bankrupted their victim nations and allowed U$ corporations to pick up assets and public utilities for pennies on the pound.

Closer to home was the 1997 Asian Financial Crisis, which originated in Thailand with the collapse of the Thai baht and the capital flight after they were forced to float because of their lack of foreign currency to support the peg to the U$ dollar.

This spread quickly to many other southeast (SE) Asian countries and later to Japan and South Korea as well. The result was slumping currencies, stock markets, other asset prices, and a massive rise in debt with debt:GDP ratios rising by 100-180% in all of the largest economies.

China assisted in the damage control by making $4 billion available in bailout money, and by not devaluing its own currency. However the tide of capital fleeing these countries was not stopped and the authorities had to cease defending their exchange rates and allow their currencies to float. Their foreign liabilities grew massively in domestic currency terms, causing even more extended carnage.

The ASEAN countries believed that the well co-ordinated manipulation of their currencies was a deliberate attempt to destabilise their economies. The Malaysian Prime Minister, Mahathir Mohamad accused George Soros and other currency traders of ruining Malaysia’s economy with currency speculation.

Long story short, the carnage from this Western contrived pump and dump debacle was right on their doorstep and it remains very vivid in the minds of all of these SE Asian BRICS+ bloc members.

The NDB (New Development Bank) was tasked with helping to finance developing countries, and Russia in 2023 offered 25-50,000 tons of free grain to six struggling African nations.

In short it is obvious that China sees the real priority is to support Russia and the BRICS+ bloc, together in mutual cooperation in a 21st Century industrial revolution for the benefit of all member countries, their productive economies, and to build sustainable future wealth.

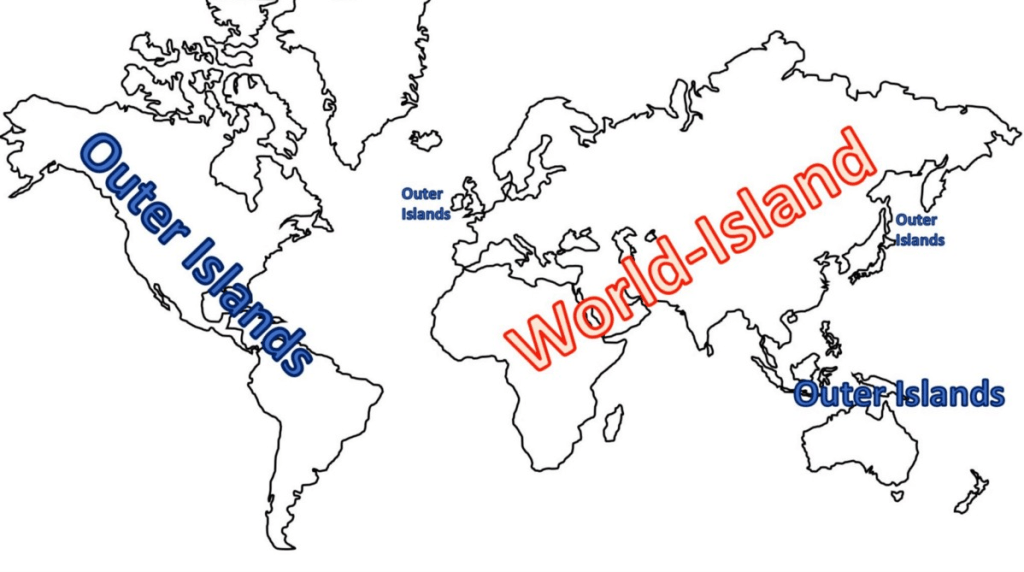

Halford Mackinder’s Heartland Theory: the Afro-Asian “World-Island” at permanent struggle with the Rimlands

10. Mackinder’s 1904 theory was right – the ‘World Island’ he predicted has indeed become a reality.

This could well be recorded for posterity as the major geopolitical pivot in the history of our species.

Now we await the announcement of the new hard backed trade instrument as soon as the BRICS+ nations are satisfied with their bullion stacking, and a non synthetic market driven price discovery for gold and silver takes place. IMO it will work admirably because a better alternative to the unbacked fiat countries will be, not only available, but utterly compelling for trade settlement purposes, but also in terms of stable and secure reserves.

The US is in an impossible debt trap now and the Fed has lost control – the cost of credit is too high for the massive amount of debt entrenched in the system and if the dollar weakens, inflation will be off to the races even further.

Official inflation figures are a complete croc anyway, and as John Williams reported 5 months ago for August 2023, when the official CPI was headlined at 3.7% YOY, his estimate was 11.5%. If the changes weren’t made to the calculation formula between the 80s and the early 2000s, they would be forced to report the double digit number.

When the inflation figure is manipulated to this degree it means that the Fed is in reality, operating outside of the price stability mandate. Given that employment figures are completely fictitious too, that many part time jobs are included in the total, and people no longer looking for jobs are excluded in the formula, this figure is a complete croc too.

To me this means that the 100% privately owned Fed is not operating within any effective mandate whatsoever, and even more outrageous is the fact it hasn’t had a proper audit for over 70 years!

11. Has the U$ and the West reached peak stupidity yet?

No, it seems they are still working on it – figures below are from…

- US National debt $34.34 Trillion – 123% of GDP

- National debt per citizen $102,000

- National debt per taxpayer $ $265,000

- Social Security Liability $26.6 Trillion

- Medicare Liability $40.8 Trillion

- Unfunded Liabilities $213 Trillion

- Liability per citizen $633,000

- Liability per taxpayer ~$850,000

- Student debt $1.7 Trillion = per student $38,900

- Credit card debt #1.38 trillion = per holder $8,131

To try to put the public debt into perspective I compared the US External National debt to the highest 30 debtor nations of the world. I took out the 17 of those that were NIIP positive (Net International Investment Position) – ie net external assets less liabilities, and at the current $34.34 trillion, this was more than double the debt of all the rest of the remaining 13 net indebted countries combined.

On present trends by 2031 every single penny of tax revenue will go just to pay interest on debt and spending on social security, which is already in a $70 trillion dollar hole.

Even more crazy is the fact that the U$ informed Saudi Arabia of its intention to transition into ‘green’ energy ASAP, when the KSA was the key lynchpin to saving the petrodollar, which was in turn the only possible saviour of U$ reserve currency status.

One of the common criticisms of BRICS+ bloc is its incredible diversity – I see this diversity as a strength, with each country bringing varying degrees of raw materials, energy resources, manufacturing prowess, and logistics, to the table, in a giant bloc that is no longer beholden to the West.

12. Overseas Investment in the US

Around $33 Trillion in total – made up of…

— $7.5T in short term investments – bank deposits, treasury bills, and corporate bills

— $14.5 is invested in equities and the balance in Treasury bonds

If the confidence in the U$ economy and its fiat currency starts to slide, will these foreigners stay in these investments if they have viable alternatives? Some of this $33T will obviously flee into gold. Some will go into China because with its massive infrastructural investments in Africa, Asia, and LatAm they will be seeking these capital inflows. Some of this capital will flow into entities stockpiling commodities, as this is a hedge against the fiat currencies’ declining purchasing power.

The West is hamstrung though, as it probably has at least 10,000 tons of gold with multiple ownership, as so much has been swapped and leased out.

Investing in real estate in countries where their currencies plummet can be problematic too. History showed that rents in Germany in the 1920s fell so much in real terms that a property could become a liability because maintenance and ownership costs could overtake income. This effect does not happen with money held in gold and silver. In a currency crisis this effect can become a deterrence to invest in some normally reasonably hard asset classes.

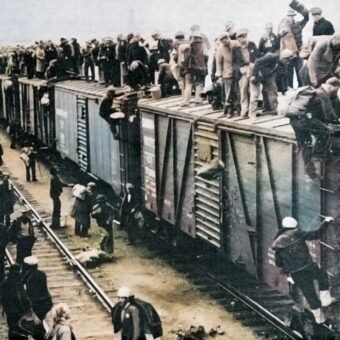

Conclusion

Clearly this monumental transition won’t be just about sound money and economic principles. This fix requires genuine statesman and the governance structures that have their citizens and nations egalitarian and long term interests at heart. This is evident within the RoW and BRICS+ governance and leaders, but is sadly lacking within in the Western train wreck.

Tragically it seems that the West will need to comprehensively crash and burn before the political appetite ousts the current treasonous bunch from office. Of course, there remains the danger during the transition period, of even more dangerous tyrants gaining power.

I predict an imminent watershed of U$ states seceding from the Union without radical changes in the behaviour of central government. So much for Uncle $laughter’s obsession with endeavouring to carve up the Russian Federation like a side of beef for the taking – the shoe could well end up on the other foot.

The BRICS+ bloc members don’t even need to interfere, as the West is doing far more to self-destruct than if all of their rivals combined together to deliberately try to undermine the hegemon.

I think the formal announcement of the new trade instrument will only eventuate when the BRICS+ bloc members have completed their bullion stacking, and as the new physical market discovery process begins in earnest.

The entire process to date amounts to a period of ~17 years or so. The new bloc has had all that time to carefully study historical models, and to design the new functional model accordingly.

Methinks they will get it right, especially since they hold a full hand of trump cards – including the left and right bowers, the Joker (Mr Putin) and enormous stacks of chips on the table as well.

Colin Maxwell

Best read of the weekend, thank you Collin, I’ve learnt quite lot from your article and being an Aussie, I was fascinated with the CBA information.

So glad you enjoyed the read, Hass. Yes, the fact that Aus lost that CBA model is an absolute tragedy. NZ squandered all of our public utility banking working models too. Both countries could have been economic powerhouses with zero debt if we had hung on to them. I gather… Read more »

This subject just took on a whole new dimension with this very revealing article by Pepe, via Sputnik. It covers his meeting with Sergei Glazyev at the EEC where he had an exclusive one-on-one with the man himself – PRICELESS!!! https://sputnikglobe.com/20240228/rocky-road-to-dedollarization-sergei-glazyev-interview–1117034183.html There is a huge amount in here to digest… Read more »

Thx! I am arranging it and hope to have it up later today. Pl save your valuable thoughts for that post. NOTE, as these major milestones of our next millennia are being set, the orgy of cannibalism in Gaza, and the nuclear war centered on the northern hemisphere, accelerate! Not… Read more »

dear colin, you are like michael hudson, you both know the eCON so thoroughly as to present this rubric seamlessly. awesome work, bravo! thank you for the history of the australian public bank. denison miller, an unsung hero who all but saved the world.

Thank you, Emerson. If there remains an appetite amongst the GS community – perhaps I should do one every 2 weeks, just so as not to be too cluttering within such a busy and proactive blog site. At this stage, I have at least 3 more parts planned, so we… Read more »

dear colin, your marathons are a date to look forward to,🙏🏿 again like michael hudson, invariably we learn some essential, a piece we were missing & yes more than a few times i have to revisit a paragraph, b/c what you & michael unpack with sublime deftness requires integrating before… Read more »

Colin; Thank you for your focused and obviously well organized approach. I like the way you tie quality analysts into a unified approach. I was really touched to hear that New Zealand is participating in the assault on Yemen, “despite the disapproval of the majority of its citizens.” For me… Read more »

Thank you, Snow. Your question… …don’t you think the solution you advocate needs to be a component of some sort of unified global movement, rather than piecemeal where each nation operates individually as if dealing in isolation? Yes, definitely. And that’s precisely what the BRICS+ bloc is. On a global… Read more »

The US Dollar “reserve currency” status and the “exorbitant privilege” that America extracts as a result are weasely euphemisms for a system of American parasitism. That is the best way to describe this US Dollar system. In fact, Mr. Putin himself has explicitly stated that the United States of America… Read more »

Too true, xvfsb. ‘Super Imperialism’ was first published 53 years ago, and with only minor additions to the 2003 and 2021 editions – it remains cutting-edge to this day. Michael, Ellen Brown, and Richard Werner are far and away the three largest influences in my banking and money/currency studies. Regards… Read more »

Another marvel! Dear Col, I could read your work endlessly, not merely due to fluidity of prose and cogency and relevancy to our key global torment (money-lenders, AKA the Banksters), but you simplify the matter. This is hallmark of deep understanding, humility, and care for your reader, in order to… Read more »

Thanks so much, AHH for giving my work air – and I’m very appreciative of your extra editorial touches with the illustrations etc – BRAVO!