eCONomics Part II: Solutions to the Western Train Wreck

For GlobalSouth.co by our Colin from New Zealand

Solutions Unearthed by a Tale of Two Economies

A SEQUEL TO PART 1 – ‘The Western Train Wreck‘ – and an effort to promote a solution orientated discussion

It seems that what I regard as an extremely important book , Scott Andrew Smith’s, ‘A Tale Of Two Economies’ released in 2023, has gone relatively unnoticed.

Of course this is entirely to be expected because of the entrenched ‘thinking’ of the eCONomists and commentators who nurture and cheerlead the ruinous Western status quo.

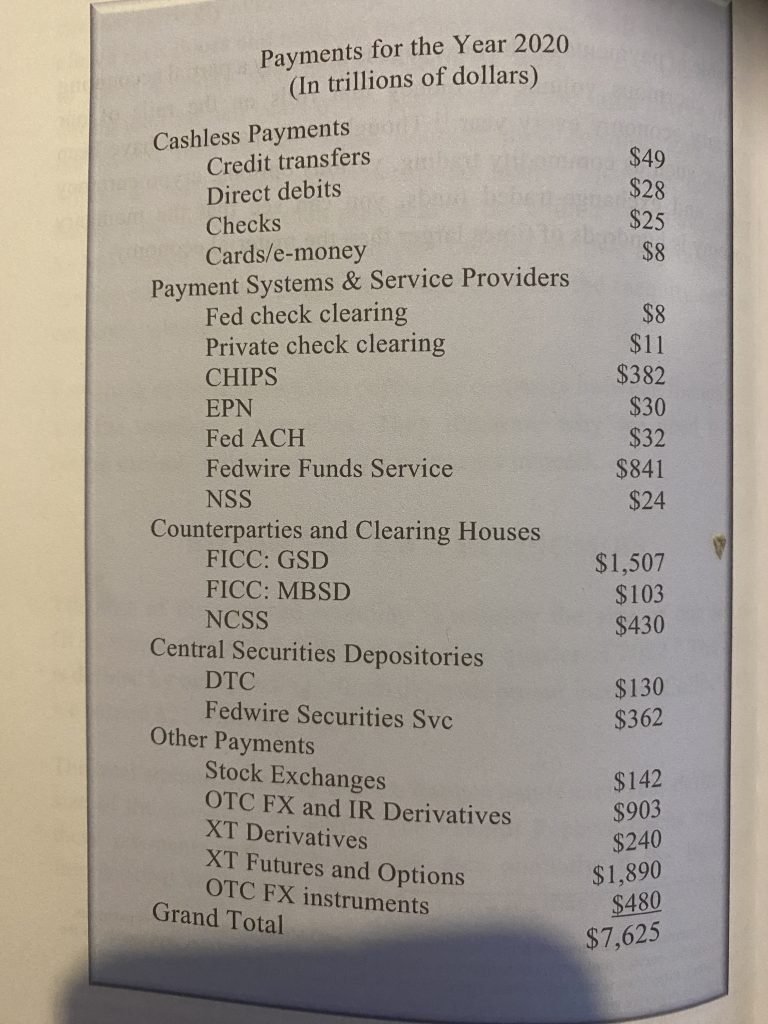

It turns out that the staggering size of the total volume of payments in the highly financialised U$ economy was not even known until the Fed began building the means to track payments in collaboration with the Bank for International Settlements (BIS).

Indeed, given the degree to which the Fed is compartmentalised, only a select few of them even now have a clue about this. Politicians of course were just as out of touch – I imagine that this remains the case as to date I have seen no mention of this on the MSM, let alone alternative media – hence the idea to make this subject part II of my sequel.

The Dream Team – FTT and the PBS

FTT = Financial Transaction Tax

PBS = Public Banking Solution

What I see are two distinctly different, although complimentary, initiatives which between the two could turn even the most broken financial model into a socio-economic miracle within a few short years – indeed, most often within as little as one term of government.

Both systems are stunningly simple mechanisms, which is frustrating as all hell, because that in turn generates the default reaction of at least 95% of the population – they dismiss the concept without knowing any details on the grounds that if it is that simple, it would have been done long before now.

The other automatic default reaction is that these solutions (especially any mention of Basic Income) are seen as far too ‘socialist’ and as such are the thin edge of the wedge in a slide back into communism.

Scott Smith addresses this reaction directly…

“Communism is premised on the notion that it is the worker who creates profit in the products that are produced, so if a company makes a profit after having paid its workers, the worker has been shortchanged for the value they created.

Communism was conceived of before automation as a response to the abject poverty of the 19th century. It was fuelled by the huge gap between the rich and poor, and it rejected the notion that profiting from capital investments could ever be good for society.

The issues that communism sought to address were real, and these issues still exist as shown in this book, though not to the extent they did in the 19th century. The fact that we have a middle class today shows that workers are better paid. Yet there are many who work hard and still live in poverty. The solutions in this book address these problems in a way that fuels economic growth instead of destroying the engine of our wealth, as communism does.”

Of course a huge part of the neoliberal strategy to engineer their vision of a new world ‘order’ (sic) is to point the finger at a communist takeover when in essence it is already a dead duck – NB – from 30% in the 1980s the percentage of global population ruled by technically communist governments is today down to a minuscule 0.5%.

And why the massive plummet down to 1/60th of its former glory within 40 years – BECAUSE COMMUNISM SIMPLY DOESN’T WORK – PERIOD!

In fact I have pointed out before that the U$ fought a horrible war in Vietnam, ostensibly with the aim of stamping out communism. The U$ lost the war, and then in the height of irony within a few decades communism actually defeated itself as the country of 99 million people organically transitioned into a free-market capitalist model.

The current 0.5% remnant consists of minnows Laos, North Korea and of course Cuba. What the socialist!, socialist!, socialist! panic brigade seems to miss is the fact that the US economy is ‘socialist’ anyway, only in the most obscene way possible, where the costs are born by Mainstreet, and the profits are socialised and funnelled directly into the pockets of the thieving kleptocrats.

Mainstreet and the Productive Economy Languishes

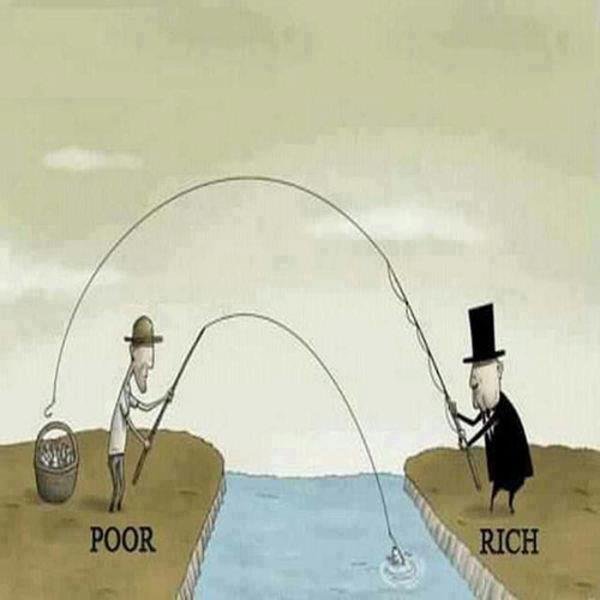

Meanwhile the bottom 50% of the population’s share of financial assets shrinks in spite of the trillions of dollars of stimulus flooding the economy.

Charles Hugh Smith has just written an excellent article pointing out how these “recession proofing” machinations by the criminal Fed have once again robbed Main Street and made a monster recession a mathematical certainty – his chart here is a real eye-opener – a reminder that everything the ‘Creature from Jekyll Island’ turns its hand to is a rich man’s trick.

The bottom 50% cohorts share of the financial assets gained a minuscule 0.2%, whilst the kleptocrats pocketed around $10 trillion.

The Two Economies

#1 Is the real and productive economy that generates genuine wealth but is penalised because it carries the vast majority of the tax burden.

#2 Is the parasitic casino financial economy that pays negligible taxes with the cartel-style commercial banks diverting multi-billions in interest payments into the hands of their oligarch owners.

This is the very foundation of the network that orchestrates the forever wars which are now hybrid techno/military in nature, in which the global private banking industry finances both sides of all of these conflicts.

The billions of interest payments that get sucked out of Western domestic economies go straight into their coffers. This same network brought us the COVID war as well. They have literally trillions of dollars at their disposal to finance ever more innovative ways of killing and thieving from Main Street.

A MINUSCULE 0.25% FTT – replacing all other taxes and funding Basic Income, Earned Income Credits, Healthcare, child care credits, free college and higher education – it sounds too good to be true doesn’t it – where on earth will this money come from?

The fact is that there is a monumental disparity between the material and monetary economies with the size of the material economy being roughly the size of the GDP, which in the U$ example in 2020 was $25.6 trillion.

However as the illustration shows, in the year 2020 the total payments were $7,625 trillion or $7.625 quadrillion!

Even though many payments like commodity trading, various options, cryptocurrency trades and EFFs have been left out, the monetary economy is still ~350x the material economy. The US GDP only represents ~0.33% of the payments made in the total economy.

Being able to see the big picture, makes the solution all the more obvious – payments need to be taxed NOT INCOME.

Basic Income Payments – Eliminating the Welfare Trap

Basic Income monthly payments for 18-69 year olds of $2,000 per month and 70+ year olds of $3,000 per month would be affordable.

The hurdle has always been how to create a basic income structure without increasing taxes. This is the whole point of FTT – the extra tax take would be from the parasitic financial economy, NOT from the productive economy.

Eliminating income tax would immediately give everyone a huge boost in their take-home pay. With the basic income payment each week added in, all wage earners would enjoy increases in disposable income.

In America with their huge income disparity, 90% of the country’s population would significantly improve their living standard.

The welfare trap and the fear of rampant socialism are the overarching concerns of the critics – IOW, how can you have a social welfare system that provides for the genuinely disadvantaged whilst not propagating an institutionalised multigenerational welfare trap?

In existing models, including within New Zealand (NZ) and the U$, when someone gets a job, they usually lose some or all of their existing benefits – as such this disincentives them from finding a job. Basic income models are the polar opposite – they incentivise beneficiaries to work.

The basic income model also encourages new business start-ups by allowing them the wherewithal and the confidence to try to establish a business that they may have always dreamed of.

Earned Income Credits

To encourage beneficiaries to work, earned income credits could be paid when they find a job. Coupled with the basic income payment this could add up to a very liveable income.

Based on Smiths figures, someone earning $15,000 would receive an extra $7,500 in earned income credits, and that bumps up to a total income of $46,500 per year when you add in basic income.

0.25% FTT was Modelled in France back in 2010

The brilliant Simon Thorpe from Toulouse in France ran the models completely independently from Smith in the U$. He came up with the exact same figure of 0.25%. Once again is is clear that in highly financially orientated economies this rate provides far more revenue to the Govt than all the other taxes combined.

In the U$ it is enough revenue to provide universal free basic health care, childcare credits, and free higher education. Within 7 years the U$ could pay off its rapidly spiralling public debt as well.

This model could work in NZ too, and if it was implemented along with Ellen Brown’s PBS (Public Banking Solution) NZ could become the sustainable socioeconomic miracle of the planet within one term of government.

Everyone is a Winner Except for the 0.1% Plutocrats

The most astonishing result that these models uncovered was the fact that all cohorts of Mainstreet benefited enormously – the only ones worse off were the thieves positioned at the apex of the human feed chain.

These were the increases in net income…

- A couple with no job – $15,000 – $47,880

- A retired couple – $30,000 – $71,820

- A couple earning $30,000 with a $100k mortgage – $18,764 – $81,953

- A couple earning $100,000 with a $300k mortgage – $51,243 – $137,630

- A couple earning $250,000 with a $500K mortgage – $145,718 – $280,588

But Won’t This Increase in Disposable Income Spell Massive Inflation?

As Smith explains…

“Inflation is always a risk whenever people have additional money to spend, but if the production capacity of the material economy, including that of foreign companies, is sufficient to support the additional spending there will be very little inflation – the key to minimizing inflation is to finance a diverse and robust supply chain.”

Furthermore, this new paradigm would encourage the return of a savings culture, and this would make low-interest rate liquidity available at a local level where moral hazard restraints would once more play a big part in making soundly based loans. Lower interest rates are disinflationary too.

Budget Surpluses Could Be Used to Generate Future Wealth

some examples…

- Building up reserves for rainy days and natural disasters

- Improving infrastructure

- Funding desalinisation projects in countries with water challenges

- Funding improvements in manufacturing capacity

- Developing new high-tech technologies

- Developing new value-added industries so as to maximise existing production

- Funding projects that strengthen the nation’s general well-being, including education, health/mental wellbeing, arts and crafts, and cottage industries etc.

Summary

“The marvel of all of human history is the patience with which men and women submit to burdens unnecessarily laid on them by their governments.” – George Washington

BTW, Washington was the first, and sadly the last, independent candidate ever to become POTUS – incidentally, he was successful twice. These massive burdens have remained on the nation’s shoulders now for another 226 years – when on earth will our species ever learn?

Cheers to all

Colin Maxwell

Planned Part III — Banking 2.0

A discussion of the fact that ~97% of the money supply is already digital and created instantly out of thin air by the touch of a button. National and international implications and the financial instruments that could work in this brave new financial world without causing inflation and liquidity squeezes.

This is another reason why BANKING 2.0 needs to be run as a public utility and as the first key step in a transition to the PBS in which all tiers of banking are available as public utilities – this would not preclude privately owned banks, it just means that they would have to compete with the PBS model to remain in business.

I was hoping to try to cover that subject in Part III, Emerson – and so I might try to give it the attention it deserves there, rather than limiting it to the confines of a comment. I am pulling info together right now, and I learn as I write… Read more »

dear colin, i look forward to part 111! ⭐️ 🙂 thank you.

dear col, thank you for your kind words regarding my father.

he & my brothers, much older, would spend hours debating keynes & his bancor. if this subject isn’t too OT, i wonder if you might elaborate how, if @ all, bancor might play in brics+?

Thumbs up to Public Banking. the kind Oz and Nz used to have before they were sold out from under us by successive governments. China has a public bank that is not owned by the international system or the internal oligarchs. Regarding the featured bookI do think its a little… Read more »

It would take Australia and New Zealand having socialist revolutionary Governments to prevent them from surrendering their Public Banking to the Imperial private banking cabal.

Instead being bourgeois they allowed the empire to dictate, as always. The necessary lesson waits to be drawn.

With the utmost respect K, just me but I don’t view China as technically Communist anyway. As you probably know I am merely a student of political science and a purely self-taught one at best. Compared to the likes of Jeff J Brown, I am a mere babe in arms… Read more »

Col, thanks for such a detailed response. You insist that China and Vietnam are not technically communist as they have mixed market economies, but that is not how they view themselves. They see themselves as communist. We need to respect that. Furthermore, their position is in line with Snowy’s point… Read more »

Hi Steve, as a Vietnamese, I can attest to Col’s statement that the Vietnamese don’t see themselves as Communists, even members of the Communist party themselves. It’s just a label, a historical artifact if you will, to keep everyone unified. Ever since the early 90s, what we’ve been following is… Read more »

Minh, thanks for your input. You said that in regard to the Vietnamese view of communism, “It’s just a label, a historical artifact if you will, to keep everyone unified.” But that’s the whole point, isn’t it? To have a unifying ideal based on a noble aspiration — the general… Read more »

@Steve, as you said “What’s relevant is the view of the people on the ground who are working their guts out to make a better Vietnam. If they are happy with current progress towards socialism, that’s all that matters. If they want to call it communism, that’s all that matters. ”… Read more »

Minh, thanks again. Great input, and it was particularly uplifting to hear your account of changing attitudes in Vietnam. That they are “starting to realize the true values of human life, i.e., what makes one human.” You’ve made my day and given me hope for the future. If only we… Read more »

Thanks for your generous response Col, great reading 🙂 yes i do believe we see things in a very similar way. To my understanding, Communism is not primarily about who makes or deserves the profit it is about the people owning and controlling the means of wealth, this means it… Read more »

K; Your comment about the main feature of communism makes a lot of sense. Mao set up the Chinese system of Government to allow for a process where to use his own words; “the people supervise the Government.” This is an essential feature of Maoism. China has a variety of… Read more »

Col, two great articles, but I’m a bit puzzled as to why you inserted your dislike of communism for no good reason that I could see. You said “Communism simply doesn’t work. Period.” Is that actually the case? Can we overlook the fact that every communist regime AFAIK has been… Read more »

You are quite right Steve. It would take a socialist revolution to implement the structural changes to financial management Col is advocating. That fact seems to be overlooked. China is communist and proudly so, and any statements to the contrary are well refuted by the Communist Party of China. The… Read more »

Absolutely, my friends Steve and Snow Leopard too – I take on board your comments – interesting that many are one and the same with K’s extremely valid observations. Hopefully, I have clarified my position for all of you in my reply to K – but by all means, chase… Read more »

Dear Colin: There is a wonderful feature of real socialism known as a process of “criticism, struggle, transformation.” One’s ability to constructively engage that process within one’s self in relation with others, is a measure of the quality of one’s practice. It feels to me that you are contributing with… Read more »

dear col, your first two chapters have the elegant simplicity of a formula while wonderfully transparent for those of us fumbling our way through the gibberish of eCONomists. bravo!

Thank you, Emerson – I regularly reflect on the awesome balance sheet your country Canada had until the crook ‘Truedough Senior’ sold it out to the City of London/ Wall Street cartels. A HISTORICAL SUCCESS STORY TURNED INTO A TRAGEDY The then Bank of Canada was amended in 1938 into… Read more »

dear colin, you’ve flayed canadian history like no one ever has. forgive me if my response is nonsensical, i am reeling, grasping for the hand rail. first: thank you. i wish your words could reach all canadians. i vividly remember dinner discussions; my father saw what pierre was orchestrating. my… Read more »

NZ and Australia have similar tragic tales to tell too Emerson – we also allowed hugely successful working PBS models to be utterly squandered.

All three countries are junior members of the so-called ‘Commonwealth’ – we were always going to be sitting ducks.

🦆🦆 thank you, colin. 🦆 i am beginning to appreciate my father, recovering from the horrors of being used in an orchestrated war bloody & yet nurturing promise & the possibility of change within each of us.

forgive me, col, life intervened & i posted in haste, before completing my thought. it wasn’t much, but in haste i lost my point entirely. simply–my father tried to warn the world around him of the devastation trudeau’s deceitful gutting would have upon canada. few listened, old friends shunned him,… Read more »

No not at – this is very important Emerson – clearly your Dad was a visionary with enough life experience at the time to see that Canada’s squandering of the PBS was simply another rich man’s trick. Only a tiny percentage of the population would have been able to know… Read more »

Colin Maxwell, that was clear, simple and concise and your passion for fairness burns in every word, I enjoyed reading it. I assume all of us here have tried to awaken our fellow citizens to these simple truths and got nowhere, they still go out and vote for their own… Read more »

Thank you Archeon! – it can be quite the challenge to try to write on financial/economic subjects without becoming tedious and then losing 95% of readers before the end of the first paragraph.

Illustrating possible solutions, and minimising obscure acronyms, and overly technical terminology, seems to engage more readers.

A Tale Of Two Economies’ reminds us of “A Tale of Two Cities” by Charles Dickens, who opens his novel with the poem : It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the… Read more »

Another joy! Thanks dear Colin. “With the basic income payment each week added in, all wage earners would enjoy increases in disposable income.” Can we argue that it is precisely the very possibility of such fair systems arising being fought tooth and claw by totalitarian supremacists already working hard to… Read more »

Thank you, AHH. Your point… “So our first task worldwide, as in 404, remains denazification and demilitarization of malignant parasitical overlords of Feudal Oligarchy, as aptly described by Prof Hudson.” Yes, and this is precisely the message that Putin got out loud and clear in the Carlson interview. Russia already… Read more »