Ukraine and Middle East wars impact on Europe

With thanks to our author Jorge Vilches

( Part II )

European blues

Europeans are having second thoughts about their geopolitical standing vis-à-vis Europe’s real strategic interests. For example, the Ukraine war has left many millions of jobless Ukranians plus family now stranded all over Europe with no return in sight. This has a high cost beyond the diplomatic and financial cost of having supplied Ukraine with failing yet billonary weaponry. The Ukraine war has also caused the interruption of key supply chains involving essential raw materials and feedstocks such as energy which until effectively solved mean that Europe will never be what it was. Without the NS1 and NS2 pipelines, now LNG sourcing is paramount as winter knocks ever louder on the EU door.

Furthermore, NATO’s defeat for the vintage European mentality means nothing less than a genuine moral catastrophe

Meanwhile the ongoing ME war is jeopardizing the (precarious and unpredictable) LNG supply lines despite paying sky-high prices. So cracks are emerging in the EU leadership finally realizing that without their vassalized support the US would lose hegemony ASWKIT. Sanctions and Russophobia will continue to hurt Europe far more than Russia which, beyond its obvious military success, has also ended up economically stronger and better positioned into the future.

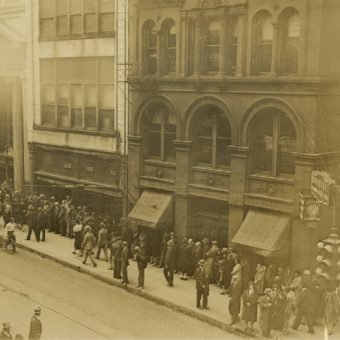

Furthermore, a massive amount of MENA migrants are currently in Europe after years of NATO G7 systematic and unwarranted bombings with induced violence and destruction which constitute a formidable political and social force that now needs quick assimilation in a hurry. Such is no easy task under current circumstances and most specially if Europeans are rapidly changing their minds and hospitality attitude towards differently-colored migrants. For example, a new poll today reveals that 60% of Germans no longer want any migration from Islamic nations while almost 80% believe that a growing contingent of the country’s migrant population resents German society and Western values…

( Part I was recently posted at https://sovereignista.com/2023/10/26/the-middle-east-war-and-europes-lng-implosion/ )

So…

Beware that without European support the US hegemony would be left spinning idly in a very lonely vacuum. So should Europe rise to the occasion as it seems some Europeans are thinking, it would pretty much be game over for the US ambition to impose its will upon the whole wide world. So Europeans are now feeling they may hold a card that could favor their future. Whether such trump card will be effectively used is still anybody’s guess. What would tip the Overton window of public opinion would certainly be the failure (or sheer lack) of basic stuff and services, food, etc.

And what most Europeans do not realize yet is Germany´s role in the now uber-high electricity prices all over Europe. The reason is that the EU’s common energy market forces energy producers to sell on the open energy market. So non-Germans must outbid what Germany is willing to pay thus driving prices ever higher and beyond comprehension.

LNG and the Energiewende rules

The Paris Agreement and the EU Green Plan require to “DE-carbonize” with net-zero GHG emissions by 2045 for Germany + Sweden and by 2050 for the rest. Dr Patrick Moore — Greenpeace co-founder – thus warns that 50% of mankind would die by lack of nitrogen fertilizer while also stranding millions of diesel-powered machinery and shutting down thousands of farms with culled livestock… also requiring a highly risky, massive, carbon-enriching overhaul of electric facilities and grids to avoid outages (over whose back yard ?) by 150 MM kms. at 2022 costs of USD $ 25 Trillion including steel and cement… while chopping down many millions of trees. Still, electricity cannot ever substitute fuels required by heavy equipment for mining, or air travel, shipping, construction, military, roads, etc. Also the ultra-heavy, short-lived, explosive-risky, ineffective, expensive and very-slow-to-charge EV batteries is yet another unsolvable. Per Toyota, hundreds of dirty new mines are needed globally (also in China & Russia) for ever-pricier battery minerals. The EU 2035 ban on new ICE vehicles requires millions of evenly distributed and ultra high insurance cost of EV Level 3 urban charging stations + no saltwater exposure (re coastal floods) + heavily reinforced fossil asphalt & cement roads + dirty toxic battery cemeteries (where?) + many dozens of prohibitive life-cycle nuclear plants ( with Russian uranium ? and ever-lower cooling water available ? ) while lacking manpower which takes many years to train, if ever. So, that.

blah blah

German outlet Handelsblatt says that the EU has simply run out of money with lots of “blah blah” on top. Many different charging networks will require individual account apps, etc., thus confusing operative availability each with different billing systems thus complicating millions of payments bigly. Copper and special GOES steel still remain absent for thousands of required grid transformers not yet built and without which no EV plan is possible. EV´s are very inefficient with power lost thru transmission lines and battery heat loss. So the 2035 ban means a dramatic growth of EVs and a drastic reduction of all things military, A/C + heating, large living spaces, desalinization plants, ships, planes, trucks + cars thus altering discretionary mobility, all with deep state control and ultra high new taxes.

Another problem is that the electricity to be generated and transmitted is necessarily AC while batteries only store DC.

Ref. #2: https://rmx.news/hungary/the-eu-is-on-the-brink-of-bankruptcy-says-hungarys-orban-at-eu-summit/

real dirty steel

Be that as it may, there would be many valid examples to discuss, but the steel industry holds the world´s record in the carbon emission footprint category by generating at least twice the airline industry and significantly more than the dirty cement industry. Of course, whatever conclusions are reached for the steel industry should also be conceptually extended to other industries, all of which will be negatively affected by the sheer absence of enough energy available.

Ref #5: https://essd.copernicus.org/articles/15/2295/2023/

Ref #6: https://www.youtube.com/watch?v=0kAb4Qq9kEc

Ref #7: https://www.ft.com/content/4a55e794-e65e-4fab-8b8c-7afd79fba7ba

Ref #8: https://www.ft.com/content/bf1b788a-f366-4637-9ae4-08dbc0bd90fa

Ref #12: https://europe.autonews.com/technology/europe-needs-65-million-ev-chargers-2035

a ´hydrogen bridge´ too far

The steel industry is promoting sophisticated – yet very limited – research DE-carbonization pilot projects. Thus, in a quite distant future (if ever) maybe the steel industry could implement ‘some’ significant though hyper-expensive super-complex and fully doubtfull DE-carbonization hydrogen-based solutions. Still, H2 generation, storage, embrittlement, transport and thermodynamic losses would pose very serious challenges, requiring LOTS of water, new pipelines, turbines, IC engines, etc. It also requires very concerning CO2 scrubbing, capture and injection wells implying ultra hazardous air and water pollution including catastrophic events. So, despite the “colors” H2 is an indirect, short lived, yet highly leaking GHG that would perpetuate the fossil fuels paradigm and would just mean only a possible pathway for a “relatively” lower carbon steel industry environment, not net zero.

Ref #16: https://acp.copernicus.org/articles/22/9349/2022/

Ref #17: https://www.iea.org/reports/iron-and-steel-technology-roadmap

Ref #18: https://www.nakedcapitalism.com/2023/11/elongating-the-fossil-fuel-era-one-trick-at-a-time.html

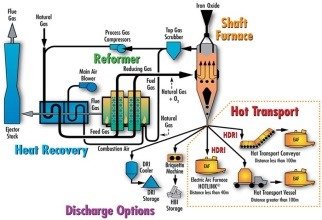

ghosting Natural Gas (NG)

So in the meantime, and during many long years, per the already-approved EU regulations only natural gas (NG) would comply as an effective and transitional feedstock and fuel for steel manufacturing processes. Because NG does at least momentarily deliver right now far lower-carbon footprint steels while the ultra-clean hydrogen (H2) pathway would only be implementable way into the future. Thus, the current highly-polluting conventional blast furnaces could be effectively replaced with lower-emissions DRI plants but only if fueled with NG. So the rules of the game now fully in-force require the immediate application of steel production routes consuming enormous quantities of NG in Europe.

But, after the NS1 and NS2 pipelines sabotage such amounts of natural gas cannot ( ever ? ) be available in Europe.

( Please re-read paragraph #1 entitled “European blues” at the very beginning of this article )

And so the only fall-back surviving “solution” is to substitute NG with LNG for most steel-making applications. And that is hugely problematic because the LNG “solution” (not) is only partially applicable, most expensive, cumbersome and risky. Also, the scarce LNG available cannot comply with the now required DE.carbonization goals of European steel.

Furthermore, LNG might be “richer” than NG ( sorta, depending upon applications ) but it still requires to have a constant composition (beware) and specific matching (fine tuning expertise + right manpower) with the equipment it´d be fed into. Existing European applications were always fed constant Russian NG and were also 100% matched & calibrated to such without need for ongoing modifications. But new LNG feedstock ´mixes´ also require to be just as constant (impossible ?) or otherwise be permanently harmonized and tuned ad hoc per their unavoidable well- known variations.

DRI production per International Iron Metallics Association

LNG process modifications

Regasified LNG can only be used after the combustor / burner is duly fined-tuned to the specific LNG quality it is fed with. This matching is needed, be it a pure LNG or intermixed or blended with other LNGs and/or NGs, and as long as whatever is fed also has quite constant physical-chemical specs. There are many possible variations which can affect both industrial equipment (even turbines and/or ICEs) and domestic appliances all resulting in higher emissions, plus decreased efficiency, outright outages and probable generation of toxic waste from poor burning, carbon monoxide & dioxide, hydrogen sulphide, ammonia, volatile organic components, and particulate matter re soot, etc. This means much higher maintenance costs and unexpected down-times. Another nuisance that gas technicians can attest to is the problematic homogenous combustion across a wide range of different gas qualities. There are many potential drawbacks for variable LNGs when used in facilities that have been adjusted only to pipelined Russian NG since time immemorial. In this case regasified LNG batches – either pure or blended — should also need treating before feeding into equipment that was previously finely calibrated to consume leaner, yet constant, Russian nat-gas. Feedstocks logistics goes haywire with LNG and thusly they don´t get along well. US shale gas LNG complicates this even further.

Before 2022 for decades Europe enjoyed continuous, cheap, dependable and predictable Russian pipelined NG. Specially Germany´s industry and homes expected and received nothing else for daily consumption, power generation and/or industrial feedstocks purposes. Now Germany can only import some pipelined nat-gas from Norway and The Netherlands although with different specs which require adjustments, probably difficult, expensive, and very time-consuming. Or a hodge-podge of varying LNGs which — if US sourced – would have embedded fracking problems built-in such American “shale gas LNG”. This would also require special processing adding to already very high costs.

( Please re-read paragraph #2 entitled “So… ” at the very beginning of this article )

Groningen OUT

By October 2023 the neighboring Dutch plan to shut down their tremor-prone Groningen nat- gas field today providing Germany huge amounts of NG. But, as expected, earthquakes have crashed real state valuations near Groningen terrifying almost 100,000 families and many times destroying their livelihoods for good by geopolitical vested interests.

Improper mixing of natural gas NG and shale-gas LNG has to be avoided so EU maintenance departments better get their feet wet soon enough. This also involves the subsurface Russian NG reserves that supposedly remained stored underground and/or NG brought in from elsewhere. Without constant proper matching and precise calibration with the equipment it is fed into such improper new feedstock would negatively affect the functioning of devices or equipment facilities which for decades have been conceived, designed, manufactured, fine-tuned, installed, contracted, operated, serviced and guaranteed while receiving exclusively a foreseeable and constant composition of Russian nat-gas (NG).

Ref #21: https://publications.jrc.ec.europa.eu/repository/bitstream/JRC47887/eur%2023818%20en.pdf

Upstream oil and gas is a very high-capital intensive business, so the 2045 EV Plan crashes head on with rising interest rates thus discouraging possible investments in new processes, drilling, exploration, pipelines, or refineries that take many decades to design, get approved, built, commissioned and payed back if ever under these conditions.

comparing NG vis-à-vis LNG

NS1 & NS2 NG supplier: decades-long, vetted, reliable single vendor with unlimited supply delivered on-demand

LNG suppliers: many partially possible yet uncertain and variable, with many risky & volatile “spot” contracts involved

NG all-around emissions + leaks: medium / low

LNG all-around emissions + leaks : very HIGH, liquefaction, cryo-storing, handling, sea-borne freight,degassing, leaks

NG intrinsic process emissions: medium

LNG intrinsic process emissions: medium

NG gas fields fracking pollution: there are no fracked wells involved in Russian NG supplies. So it would not apply.

LNG gas fields fracking pollution: over abundant throughout and also mostly ignored in carbon-footprint calculations.

US fracked LNG

The huge amount of LNG which Europe imports from the US is mostly produced from fracked wells rendering “shale gas LNG”, both off-shore and on-shore. Fracked wells today in the US are multiple times more abundant than traditional un-fracked reservoir wells. Also fracked wells are very short lived and deplete ultra fast in comparison to traditional reservoir wells. So fracked wells in the US are abandoned faster than what new wells can be drilled (I kid you not) many times leaving behind huge masses of rotting and eroding infrastructures and other un-remediated messy messes. Of course,such huge high-carbon infrastructure clean up costs are ultra expensive, most specially in the off-shore environment such as the Gulf of Mexico where the US has innumerable amount of fracked wells now producing shale gas LNG exported to Europe. Abandoned infrastructure and uncapped wells anywhere also count.

Allowed flaring or venting gas at the source may also reach a whopping 9% in Permian and Bakken Basins in the US. Ref # 23: https://www.nationalobserver.com/2022/06/02/news/residents-rising-damage-natural-gas-expands-gulf-mexico

photo credit Wikipedia

Norway´s off-shore wells

Norway does not usually frack any of its wells, but all of them – now even in the Barentz Sea — are always off-shore, most of the time in ultra tough weather and very difficult-to-access high seas. So the corresponding clean-up and environmental impact studies of stranded infrastructure in both cases (US and Norway) should reveal many dozens of billions of dollars and euros that are not taken into account for calculating the final effective carbon-footprint of same.

In the North Sea alone over 8,500 kilometers of pipelines are no longer being used and 85% of all the wellbores – or 25,000 — have been abandoned. Lots of dozens of platforms have also been left sitting pretty towering above North Sea waves. All of the above has an environmental carbon-footprint impact never ever duly considered as it should be.

Governments and companies are an active part of the current problem while falling behind in their obligations to dismantle and remove obsolete oil and gas installations which add lots to unattended carbon emissions …” This includes hundreds of drilling rigs, thousands of oil and gas wells plus tens of thousands of kilometers of pipelines…. This sprawling legacy leaches oil, chemicals, plastics and other contaminants actively decomposing with the relentless action of waves and currents and salt water” spreading it out beyond any recovery and remediation.

the EU´s “jungle” sacrifice zones

Europe is now also subsidizing imports from their so-called surrounding “jungle” so as to remain clean within the safe perimeter of the EU “garden” and, at the same time, solve the energy and raw materials sourcing problem, water included. This has the Balkan & the North-West African “jungle” as sacrifice zones. But through their already well-known carbon footprint calculations such EU policies should easily indicate that pollution – instead of within Europe – now would take place just as well in the Western Balkans through LNG and mineral imports which also ruin thousands of family farms. Or in Morocco via importation of hydrogen or in Algeria through electrical energy import so that the dirty outcome – with cheap labor — is kept at the “jungle”, not within the EU “garden” . Same goes for equivalent type projects in Tunisia, Egypt, the East Mediterranean and other areas including the construction of oil & gas pipelines.

Ref #27: https://www.nakedcapitalism.com/2023/06/the-eu-looks-to-jungle-sacrifice-zones-to-help-it-out-of-energy-crisis.html

Ref #28: https://www.nakedcapitalism.com/2023/06/the-eu-looks-to-jungle-sacrifice-zones-to-help-it-out-of-energy-crisis-north-africa-edition.html

Ref #29: https://moneycircus.substack.com/p/eurasia-note-63-europe-reels-from

comparing NG vis-à-vis LNG

NG price: ultra LOW by multiples compared to LNG

LNG price: ultra HIGH far more expensive than NG

NS1 & NS2 NG available volumes: open 50-year contracts, unlimited, single source, 100% available on-demand

LNG available volumes: uncertain, several variable sources, many times thru volatile & risky delivery “spot” contracts

NG environmental hazard: very LOW

LNG environmental hazard: very HIGH – “The pressure in offshore pipelines is higher than in onshore pipelines, which reduces the number of compressor stations needed and reduces potential fugitive emissions, plus acidification, eutrophication, photochemical ozone formation, respiratory inorganics, ionizing. radiation, cancer and non-cancer human health effects, freshwater ecotoxicity and water scarcity.”

Ref #30: https://energijabalkana.net/wp-content/uploads/2021/11/How-to-evaluate-pipeline-gas-versus-LNG.pdf

NS1 & NS2 NG logistics: superb, reliable pipeline door-to-door delivery

LNG logistics: poor, unreliable, sea-borne batch delivery, messy, additional pipeworks almost always badly required.

NG grid flowability: excellent

LNG grid flowability: not as good re density issues

NG operational continuity: excellent

LNG operational continuity: generally poor, with many important issues to be solved, including volatile “spot” delivery.

NG H2 blending: good

LNG H2 blending: moderate

NG specs: uniformly constant and foreseeable

LNG specs: variable, depending upon supplier differences and unavoidable batch variations

NG storage: does not apply for pipeline delivery

LNG storage: very limited, potentially very complex, risky and expensive

NS1 & NS2 NG delivery: excellent, pipelined door-to-door, on-demand

LNG delivery: poor, sea-borne batches, spot contracts, weather events,port & terminal huge investment, complaints.

NG delivery energy input & emission: very low

LNG delivery energy emission: very HIGH, liquefaction, leaks, sea-borne cryo-batches, Boil-Off-Gas (BOG) issues

NG pre-process climate impact: very low

LNG pre-process climate impact: ultra HIGH, liquefaction, cryo-preservation , handling, sea-borne freight de-gasing

Ref #31: https://www.bbc.com/news/science-environment-63457377

NS1 & NS2 NG financing required: none, 100% amortized

LNG financing required: net-zero by 2050 and intermediate target dates almost guarantee that financing will fail.

Tons of funding as all LNG terminals and ships are owned/built/operated by consortiums of gigantic multinational companies, not governments. They cost 10’s of billions to design and build, which need to be borrowed from banks through a solid plan guaranteed to repay the loan + interest. The owner/operator of the terminal and ships has all sorts of other very important liabilities. No bank will easily bet its own farm financing a net-zero 2050 LNG “green” future.

NG operational integrity of end user´s equipment: not affected, business as usual, fully proven thru decades

LNG operational integrity of end user´s equipment:

OEM + equipment modification/retrofitting/calibration/fine-tuning both for industrial processes and power generation

NG re NG + LNG mix issues: does not apply, business as usual

LNG re NG + LNG mix issues: constant blending and calibration issues + LNG previous treatment problems

NG terminals: does not apply in pipeline delivery

LNG terminals: lacking in source ports and also at least 35 in Europe. They take many years for reliable operation.

The pre-feasibility and feasibility studies have not yet been planned for, let alone detailed engineering, plans & specs, manpower, contracting of engineering expertise, etc., etc. LNG terminal sites have to be carefully chosen, their expensive and cumbersome environmental impact assessments completed (which can take years) with engineering design that by itself can also take years with no room for direct carbon copy of other designs, plus ground preparation construction which would take 1-2 years + manufacturing of plant and modules (usually in Korea and China (!!) all of which need contracts, schedules, materials, etc, lots of TIME and shipping + certification & commissioning.

NG liquefaction & de-gasing risks: does not apply

LNG liquefaction & de-gasing risks: very HIGH construction & operational risks + leaks, investments, expertise + TIME

NG freight risk: ultra LOW, door-to-door gaspipe delivery

LNG freight risk: ultra HIGH, loading and un-loading issues, cryo-handling, sea-borne freight, leaks, de-gassing

NG expertise & training required: very LOW, available, standard, well-known

LNG expertise & training required: pending issue, very difficult to solve re millennials

NG specialized maritime crew: does not apply

LNG specialized maritime crew: very scarce not usually available, labor unions worsening expectations into the future

NG special docks & ports: does not apply

LNG special docks & ports: a minimum of 35 terminals required, years of planning, huge investments, expertise, TIME

NG land grid connection: does not apply

LNG land grid connection: many issues, investments, feasibility, requires lots of TIME

NG land grid connection equipment + installation, management & operation: does not apply

LNG land grid connection equipment + installation, management & operation: LOTS not easy to solve

NG costly cryogenic carrier vessels : does not apply

LNG costly cryogenic carrier vessels: many needed but currently non-existent, yet to be built, highly delayed delivery.

NS1 & NS2 NG freight insurance: ultra low

LNG freight insurance: ultra HIGH

NG community acceptance: very high.

LNG community acceptance: very LOW, opposition as in “not in my back yard”

Dedication

This article celebrates the memorable return of the much-appreciated and needed Amarynth as the founder / editor of the unique ´Global South´ blog. The occasion allows us all to wish that she remains in good health and with her traditional spirits plus rock solid critical thought for a very long time to come. God bless Amarynth…

So who is going to tell her ?? Germany is relying on liquid natural gas (LNG) to bridge the energy crisis. Now a study wants to show that LNG is far more harmful to the climate than burning coal. “In the worst case scenario, greenhouse gas emissions from LNG are… Read more »

right on que 3 days later re war-threatened EU energy security

https://oilprice.com/Geopolitics/Middle-East/Israel-Hamas-Conflict-Threatens-EU-Energy-Security.html

Hear hear Jorge!!!

A magnificent contribution, a reference piece, and a wonderful tribute to the A-team.

WOW, WOW, WOW!!!!!!!!

Dr. Jorge Vilches hits a homerun out of the park on this topic. He has so carefully supplied reference documentation to buttress his organized and cogent argumentation.

Dr. Vilches is a rare breed and font of human knowledge. Mi respeto y admiracion.

… by destroying Gaza, Israel would take over the Palestinian offshore gas reserves and the US would get IMEC… just follow the money and the oil & gas…

One single ship LNG delivered to Germany in AVERAGE burns 1.5M gallons and furthermore uses up about 20% of the energy delivered before another 20% is lost in compression costs. LNG requires energy to liquify the gas+ yet more energy (oil) to transport the liquified gas by tanker + additional… Read more »