The Middle East war and Europe’s LNG implosion

With thanks to Jorge Vilches, our writer.

“The Middle East war and Europe’s LNG implosion”

by Jorge Vilches

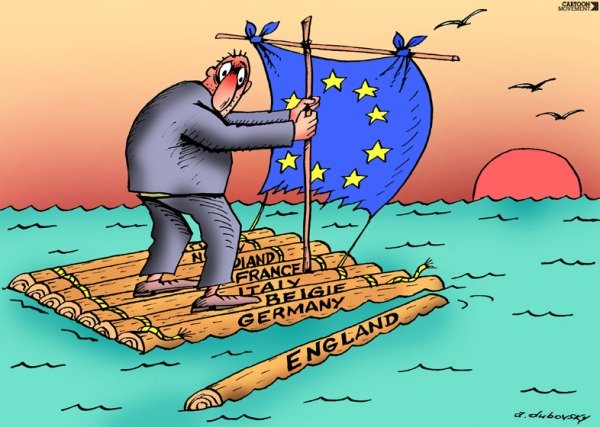

The EU was based on peace, growth, and the foremost 4 freedoms. Not upon the current painfull warfare, repression, vassalization, divisiveness, forceful migrations and hardship. Now Germany – the EU powerhouse– with this failing strategy is losing world-class exports as scarcities and much higher costs exclude investments, jobs and markets. So Northern Europe has literally lost its energy as captured leaders coordinate their agreed suicidal subservient policies in lockstep. For instance, the Nordstream NS1 & NS2 would have supplied Europe for decades with over-abundant, reliable, door-to-door, high-quality natural gas (NG). Now, both pipelines remain unavailable with no repairs foreseen. Thusly, the EU is now DE-industrializing fast with no end in sight while Germany becomes “the sick man of Europe”.

So the EU is short of a 110 Bcm potential (one hundred and ten Billion cubic meters) per year of excellent yet cheap natural gas pipelined by a fully-vetted supplier. Such staggering amount is equivalent to 65,000 (sixty five thousand) WTC towers each with an individual volume of 1.7 Mcm of nat-gas (with a 4000 m2 base x 415 mts. high) built on a surface area larger than Manhattan and Brooklyn put together (260 km2) per year, every single year, okay ? It´d be 180 (one hundred eighty) WTC towers 100% full of high quality natural gas per day, every single day, for decades…

photo credit Wikipedia

Current circumstances (including the ME war) do not allow to plan for replacement of a meaningfull fraction of such 110 Bcm potential of pipe-delivered NG with its liquefied and utterly problematic version — namely sea-borne, batch-delivered LNG. The reason is that no batch system in the world – let alone sea-borne no matter how well planned — is comparable to a well-built door-to-door pipeline which is just as important as the specs of the product. Logistics does matter lots, and having the right output at the manufacturing plant is only a part of the story. The rest is also having the right delivery at the right price with the right timing at the right place by the right people and under the right conditions at the right speed… and more. Sea-borne batch-delivered LNG is piss poor at all of that, sometimes not even able to produce the right output at processing plants, let alone delivering successfully with its very pricy (disqualifying ?) price. Tight industrial-scale schedules and just-in-time manufacturing lines simply cannot put up with any of such nonsense.

The LNG winter gambit

The problem is that Europe today cannot possibly import (or store) the amount of LNG required to replace the NG it had available before the NS1 & NS2 sabotage simply because (1) there is no such enormous LNG volume readily available worldwide not even at sky-high prices and including today´s humongous LNG imports from Russia (!!!) + (2) there are not enough cryogenic LNG carrier vessels duly crewed and commissioned for timely delivery of such huge LNG volume + (3) nor enough adequate ports and terminals (let alone in the many land-locked countries…) to liquefy and regasify anywhere near such amounts of LNG besides other engineering matters, skilled labor & expertise shortage plus unsolvable financial problems.

[Ref #1]

Saving Europe from itself

True enough, by 2028-2030 European LNG imports may possibly compensate for an important part of the NG now absent. But not with the timing required by homes, businesses and industry. Furthermore, this nat-gas deficit will still very negatively affect (a) the quantity & quality of European products, spare parts and services (b) the standard of living and basic comfort of Europeans at large and (3) European costs proper because many core industrial sectors are still dependent on abundant NG availablity at the previous ultra low price and thus necessarily triggering off ugly inflation. In addition, this NG scarcity also prompts the current cascading “DE-industrialization” process (no economy can grow with huge job/demand destruction) that the liquified and highly pressurized version of natural gas (namely LNG) cannot actually mitigate and always at a very high price. So, trying to substitute piped NG with sea-borne LNG will necessarily be partial, cumbersome, unforeseeable & unprogramable, über expensive, and also risky… or impossible

This will very seriously affect Northern European countries which were directly benefiting from the over-abundant and cheap NS1 and NS2 natural gas (NG) supply when it existed, not anymore. Broadly speaking, Europe will be ever less competitive, meaning both exports & imports will decrease thus shrinking PPP-GDP while social demands remain the same… or larger. So Europe is already dragged down by a DE-industrialization + re-location downward spiral as far less energy at much higher prices necessarily means quality downgrade, lower production, less jobs, higher inflation and thus investments made elsewhere, not Europe. So — per Say´s Law domino effect – and with NG scarcity so far meaning between 1 and 7 trillion in deficit subsidies depending upon the source and the calculation scope used, the direct and indirect energy scarcity impact means that the EU will become a shadow of what it was a few years ago…

[Ref #2]

[Ref #3]

[Ref #4]

[Ref #5]

The Middle East war

The full impact on availability and prices of oil & gas and derived sub.products (including 30% of world LNG) triggered either directly or indirectly by the ongoing Israel-Palestine war is yet unknown. But it surely could be quite large at just about the worst possible moment with winter knocking on European doors and with LNG demand expected to soar by 30% in November. So imagine the situation if OPEC+ were to declare an oil embargo and/or if Iran or others should close off (or simply disrupt) sea-borne traffic through the Strait of Hormuz — or the Suez Canal – thus badly hurting the West with yet stronger DE-dollarization dynamics. This Middle East region is home of “ vital maritime transport routes for energy, commodities, and nearly half of global maritime trade. The costs of such a conflict would be staggering, jeopardizing future assessments and investments “. Or if per Senator Lindsey Graham’s warning the US were to “…knock Iran out of the oil business… “ (sic) or just effectively threaten Iran or any of its regional partners.

Furthermore, a BRICS.11 polarization twist with G7 could make LNG a very scarce commodity thus generating a sudden European implosion as Western oil & gas reserves continue to deplete while both China & Japan in unison dump US bonds compounding the unstoppable US debt trap.

[Ref #6]

Energy = PPP – GDP

So Russia was favored by EU sanctions, starting with record LNG sales to Europe. Instead, the destruction of German demand has meant economic pain for EU consumers sometimes referred as “mandated austerity” so far in Germany up to 20% approx. in items such as home heating, cooking, hot water, pumps, elevators, A/C, appliances, machinery, lighting, vehicle fuels, medical attention, etc. And also broad European local and export markets and supply chains will continue to be very negatively impacted as industry & services struggle hard trying to find in LNG an acceptable NG substitute with the right price and availability for (1) all-around industrial power generation – even affecting crude oil refineries (think fuels) with a negative multiplying effect on the economy — and also (2) process feedstocks for the industry such as steel plants (later explained in some detail) which, of course, would have knock-on ripple effects upon all other supply chains be it in the automotive, construction & chemicals, machinery, farms & fertilizers, all-around freight, military, etc. Granted, if demand were destroyed badly enough, available energy would not matter much or – actually — would not matter at all. Or maybe the goal is DE-population ? Question: just how bright are Europeans?

[Ref #7]

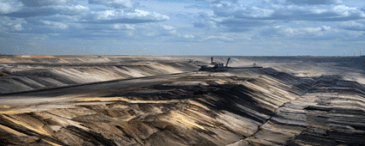

Be advised that the “EU Green Plan” has now turned deep brown as dozens of coal-fired power plants are already up and running many of which burn the dirtiest fuel ever now warmly embraced while craving for the smell of fresh lignite smoke in the morning. The result is to produce far less with much dirtier and ultra expensive über subsidized fuels. Furthermore, in order to achieve full net-zero by 2050, the International Energy Agency (IEA) has required that all fossil-fuel future commitments (including LNG terminals and carriers) must cease immediately… which means that the G7 never got the memo.

[Ref #8]

[Ref #9]

[Ref #10]

[Ref #11]

Garzweiler coal mine, Germany (Getty Images)

the LNG winter checkmate ?

So dirty lignite is king as nuclear power plants and Urals oil are now both officially forbidden in Germany which now curiously imports lots of electric power from neighboring French nuclear plants also banned in Germany (!!). Wind and solar are intermittent, limited, remote, interfering, unreliable, expensive, heavily subsidized, dirty to manufacture, install, maintain and dispose of. So then comes the idea to partially replace the much-required natgas (NG) with its liquefied, deeply subsidized and über-highly pressurized version, namely LNG, which of course would not solve the problem either as Europeans may end up left out of both. For starters, LNG is not a simple and direct plug-and-play quick-fix substitute for NG. Furthermore, producing and delivering LNG is not easy. It is complex, very expensive, not quite predictable, un-stable, hard to ship, dirty, variable and hazardous. Besides, the required type of LNG manpower / expertise is also very scarce today due to the dramatic demand increase. More than 35 LNG import terminals are urgently needed in Europe but will still take years to be studied, designed, approved, funded, built, and commissioned.

[Ref #12]

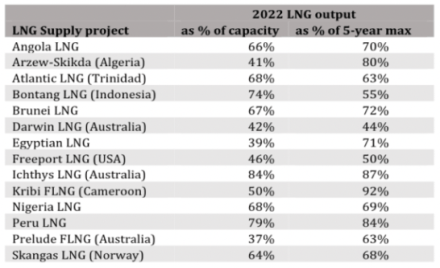

Despite very high — and still rising — prices “the LNG industry struggles to keep plants online”. Accidents and safety issues are constant re Freeport + Bucharest + Ghana´s eight LNG explosions in 3 years, etc. Maintenance problems, mechanical failures, strikes, skilled manpower & performance issues are usual. Historically at least, weather events can also be specially harmfull both for on-land facilities and seaborne freight deliveries worldwide. Today, uncomplied delivery dates are not acceptable for the current just-in-time industrial environment and simply put LNG handling is not practical nor safe.

[Ref #13]

[Ref #14]

per IEEFA calculations based on S&P Global data

Europe competes worldwide subject to delivery non-compliance with volatile “spot” sales while US lower production by Q4 2023 would mean scarcer fracked LNG. So EU procurement and production is most uncertain which does not allow for HUGE ultra long-term projects most specially with the coming Green Plan requirements soon to be imposed.

This aspect of this same topic will be analyzed in a coming article in the very near future.

Great to be reading you again after the demise of The Saker. I have just alerted Garland Nixon that you would be a great interview on his live stream. What you write here is incredibly important, to alert citizens of all western nations of the impending scarcity of fuels and… Read more »

Edward, you should really be asking before you go ahead and link and so on.

Just ask Jorge a simple question. Is he in a position to handle interviews? That is how one does it.

Bravo for an excellent article Jorge! It certainly looks like the EU is heading for a rough winter – the guy on the raft is sailing straight into a perfect storm. In fact, I think we are right on the cusp of a global financial meltdown as the frailty of… Read more »

Thanks for the encouragement Colin and I see your most valid point regarding the #typo error# in that the US was favored by EU sanctions, not Russia..

Jorge, thanks for providing references. This is important for those of us who comment on less friendly sites.

ah fab….Jorges has returned!

” I’ll be baaaaaaack…“

Please also link to a very recent announcement that just came up as Turkish President Recep Tayyip Erdogan cancels his trip to Israel. The plot thickens rapidly

https://www.rt.com/news/585860-turkey-suspends-energy-projects-israel/

> Europe now pays four times more for gas and three times more for electricity than China. The European economy cannot be competitive in such conditions,”

https://www.rt.com/business/585872-western-economy-russian-energy/